Is It Illegal To Drive Without Insurance?

Generally speaking, it is illegal to drive without insurance. The consequences for doing so vary in magnitude depending on your state. These commonly include:

- Fines

- Vehicle impoundment

- Suspension/loss of registration

- Suspension of license

- Incarceration

Though first-time offenders will not likely have the whole book thrown at them, repeat offenders could expect harsher punishments, up to and including jail time.

Even insured drivers who fail to provide proof of coverage during a routine traffic stop could face legal ramifications, albeit to a lesser degree than would totally uninsured drivers. However, your insurer could still raise your premium in light of the resulting citation.

Table of Contents

- Is It Illegal To Drive Without Insurance?

- Why Do I Need Car Insurance?

- How Does Driving Without Insurance Work?

- Are There Places Where You Don’t Need Car Insurance?

- How Much Does Car Insurance Cost?

- How To Get Affordable Car Insurance For Uninsured Drivers

- Barriers To Getting Car Insurance

- Car Insurance and You

Why Do I Need Car Insurance?

You need car insurance because the financial responsibility for damages incurred during an accident almost always falls on the driver at fault. The average comprehensive cost of an accident resulting in a fatality came out to $12,474,000 in 2021. Without coverage, the person at fault can be financially responsible for a huge bill.

It’s important that all drivers find car insurance to protect themselves from the legal repercussions of getting caught uninsured, safeguard their financial interests, and account for the liability presented by other drivers on the road.

How Does Driving Without Insurance Work?

Authorities view anyone without auto insurance up to their state’s minimum requirements as legally unsuited to drive. Uninsured and underinsured drivers alike could face a wide breadth of consequences, varying based on their location and several other personal factors.

What Does It Mean To Be Uninsured?

Being uninsured implies that you’ve failed to meet your state’s legal minimum requirement for car insurance. Registered drivers in nearly all states must possess a base level amount of one or more of the following coverages:

- Liability: Compensates other drivers for bodily injury or property damage you caused. Required in the District of Columbia (D.C) and every state except Florida.

- Personal Injury Protection: 12 states ask drivers to secure PIP coverage, which pays for your and your passenger’s medical expenses and other personal losses, regardless of the driver at fault.

- Uninsured Motorist: Pays for damages caused by underinsured drivers. Required in 20 states and D.C.

- MedPay: Required only in Maine and New Hampshire, medical payments coverage pays your and your passengers’ hospital fees, regardless of fault.

What Does It Mean To Be Underinsured?

To be underinsured means that if damage or injury expenses from an at-fault accident exceed your coverage limits, you shoulder financial responsibility for the remaining charges. For example, California requires all drivers to carry a $5,000 minimum in property damage coverage. Anybody with this minimum who crashes into and totals a luxury vehicle will still owe a lot of money out of pocket, considering that the totaled car‘s value would well eclipse their coverage limits.

While some states impose higher limits than others, drivers from areas with lower coverage thresholds do not need to worry about what to do when crossing state lines. Insurance policies automatically shift coverage to the next state’s minimum to prevent drivers from being labeled as underinsured by neighboring authorities.

How Do Police Verify Insurance?

In most states, if you get pulled over, you will be asked to provide three things: license, registration, and proof of insurance. Police will generally accept a paper insurance card, verification through an app, or ask for a picture on your phone. Traffic cops in some states, such as Texas, have license plate software that automatically recognizes whether a driver is insured.

First Offenses

Most states consider driving without insurance a misdemeanor, though do not typically impose jail time for first-time offenders. Examples of common first-time punishments, which vary state-to-state, include:

- California: $100-$200 in fines; penalty assessment fees; impounded vehicle

- New York: $150-$1500 in fines; penalty assessment fees; license and registration revoked; impounded vehicle.

- Texas: $175-$350 in fines

- Florida: Suspended license and registration with a $150 reinstatement fee

- Alaska: $500 fine; license suspended for 90 days

Repeat Offenders

Drivers caught without insurance for a second or third time will face heavier fines and legal ramifications of greater magnitude. Examples include:

- California: $500 fine; penalty assessment fees can double; impounded vehicle

- New York: Up to a $1500 fine; $750 civil penalty to reinstate license; impounded vehicle

- Texas: $350-$1000 in fines; 180-day vehicle impoundment with the driver responsible for daily storage fees; suspended license or registration

- Florida: $250-$500 in reinstatement fees; suspended license and registration for up to three years

- Alaska: $500 fine for each repeat offense; license suspended for 1-3 years

In some states, getting caught without insurance multiple times within a short span can lead to incarceration. Repeat offenders in New York could face up to 15 days of jail time, while Arkansas courts can impose sentences of up to a full year.

What Happens if You Get in an Accident Without Insurance?

These consequences increase in magnitude for uninsured drivers deemed at fault at the scene of an accident. Not only would financial responsibility for the damages and medical bills of the other car and driver fall on your head, but authorities could impound your vehicle and suspend your license for years. Some states will even throw you in jail, especially if your accident involved a fatality.

Uninsured drivers not at fault for an accident may have trouble collecting damages. Opposing insurance adjusters will claim they were driving illegally and, therefore, not entitled to compensation. These individuals could still face all the same consequences an uninsured driver could expect during a routine traffic stop, including jail time for repeat offenders in certain states.

Are There Places Where You Don’t Need Car Insurance?

Some states allow drivers to forego liability coverage if they can prove they have enough money to cover the costs of an accident, often through a cash bond or an annual penalty to their DMV. These states include:

- New Hampshire: Proof of $100,000 in liquid assets at the scene of an at-fault accident

- Virginia: $500 annual fee to the DMV

- Florida: $30,000 bond to prove your ability to pay for bodily injury claims; PIP and damage liability insurance still required by law

- Nebraska: $75,000 bond

Alaska allows drivers in many rural areas, such as Buckland, Holy Cross, and Unalalkleet, to drive without insurance or proof of financial security. These exceptions apply to very few people, as most of these zones sit deep in the wilderness and host meager populations.

How Much Does Car Insurance Cost?

Car insurance rates vary widely depending on your location and driving record. No matter your ultimate premium, securing proper insurance should always prove cheaper than the significant financial implications of an accident. Average state-to-state rates for their minimum required coverage include:

- California: $48/month

- New York: $119/month

- Texas: $59/month

- Florida: $94/month

- Alaska: $38/month

Age, gender, type of car, and the company you choose to insure you also come into play when determining your final premiums. Some companies may look at credit scores, but many are moving away from that. Drivers who want maximum coverage should expect to pay nearly four times more than the above mentioned amounts.

Does Being Uninsured Actually Save Drivers Money?

By simply vouching for a standard auto insurance plan, drivers can save hundreds of thousands, if not millions of dollars, in legal fees, medical bills, and car repair costs that could result from an accident. Fines for first-time offenders in routine traffic stops average $215, and jump to an $800 average for second or third-time offenders. These numbers do not factor in costly license reinstatement penalties, long-term vehicle impoundment bills, lost wages, or bail.

By comparison, average national insurance costs for minimal legal coverage sit at $71 per month.

How To Get Affordable Car Insurance For Uninsured Drivers

Most people can find standard car insurance for less money than expected by following the steps below.

1. Understand Your State Requirements

Almost all states require drivers to carry $20,000-$50,000 in liability coverage, whereas others might ask drivers to take out additional coverages like personal injury protection or uninsured driver insurance. For example, Georgia requires drivers to possess $50,000 in bodily injury liability, another $25,000 in property damage liability, and some uninsured motorist coverage.

Your state’s requirements will ultimately determine how little you can choose to spend on auto insurance. A trusted insurance agent can guide you through coverage laws and personally help secure an affordable policy that abides to state minimums.

2. Shop Around and Apply

Car insurance rates can swing widely from company to company, so take your time and browse for a plan that best suits your needs. Request and compare at least three quotes before settling on a final plan. Most insurance companies allow customers to do this for free and instantaneously online. You should be able to find at least one policy offering a below-average premium or one with discounts that coincide with your situation.

Car insurance companies can deny coverage for several reasons, from your driving history to your vehicle type. If this happens, simply continue searching and you should eventually find a suitable policy through one of many competing providers.

3. Pay Your Premiums and Get Proof of Insurance

Most policies will not start until a customer has paid their first premium and, in some cases, received official proof of insurance in the mail. Depending on the situation, individuals who begin driving before their insurance policy activates could face all the same consequences as an uninsured driver.

For example, suppose you have yet to receive insurance documentation and get pulled over in California. The presiding officer could assess you for a $100-$200 fine and even choose to impound your vehicle. However, courts may reduce or reverse these fines for individuals who can provide proof of insurance within a few days of the incident.

Barriers To Getting Car Insurance

While most people should find getting car insurance relatively straightforward and affordable, some populations may need help accessing coverage. No matter who you are, the benefits of car insurance always outweigh the risks of driving uninsured. Luckily, strategies now exist to assist the following groups of people in obtaining coverage.

Undocumented Immigrants

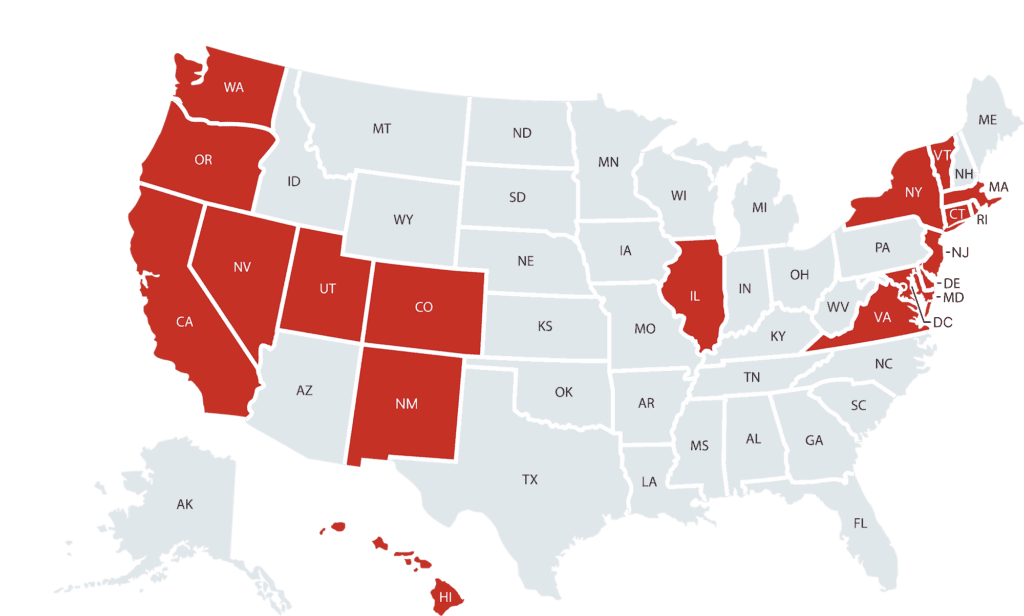

Insurers have traditionally only granted coverage to individuals officially licensed to drive by their state, effectively barring undocumented immigrants from access to auto insurance. However, as of November 14, 2022, these 19 states have introduced programs allowing undocumented people to apply for a driver’s license:

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Illinois

- Maryland

- Massachusetts

- Nevada

- New Jersey

- New Mexico

- New York

- Oregon

- Rhode Island

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

Driver’s license in hand, undocumented immigrants can now seek auto insurance through the same process as everybody else. However, they should note that their insurance company will likely classify them as a “new driver” and charge them a higher premium.

Drivers With DUIs

At the bare minimum, insurance companies will raise rates for drivers with a DUI on their record and ask them to file an SR-22, an official document proving they have legal coverage. Many other insurers will double premiums or flat-out deny coverage for individuals with a felony DUI.

To lower their annual premium, people with DUIs can raise their deductible or ask about insurance discounts for which they might still qualify. Maintaining a spotless driving record over the next few years can also help incrementally lower the cost of insurance. Most importantly, first-time offenders should firmly avoid a second DUI.

Drivers With Extensive Accident Histories

As with DUIs, insurance companies will view drivers with extensive accident histories as high-risk—and will inflate their premiums or outright deny them coverage. Luckily, many states have created assigned risk programs to provide a secondary insurance marketplace for difficult-to-insure drivers. Participating companies collectively cover and share the risk of each high-risk driver, typically for a markedly above-average premium.

Other people who might need to explore assigned risk programs include those in high-crime areas, people with bad credit, or owners of high-speed or specialty vehicles. Once insured, these individuals should continue improving their driving record to increase their likelihood of eventually securing a more affordable policy.

Car Insurance and You

No matter your situation, the benefits of car insurance far outweigh the risks of driving without it. Involvement in a fatal accident while uninsured can cost you hundreds of thousands of dollars and occasionally result in jail time.

Fortunately, securing car insurance should prove relatively straightforward and affordable for most people. Talk to a trusted insurance agent to help you find a plan that best suits your needs.