Many people are concerned by the amount of their paycheck that goes toward insurance. In fact, workers in 37 states have health insurance premiums and deductibles that account for 10% or more of their income. Insurance is intended to protect people against unexpected emergencies, but the rising cost of living can make it a growing financial challenge.

We analyzed the percentage of income that goes toward covering the average cost of auto insurance, health insurance, and life insurance in every state. Read on to see what we found.

Methodology

Using internal data along with public sources for reference (Forbes, Business Insider, and the Kaiser Family Foundation), we analyzed the monthly and yearly costs for auto, life, and health (with employee coverage and without employee coverage) insurance. From there, we calculated the average yearly spend on insurance as the combined total of the following:

- The average yearly car insurance premium cost by state

- The average yearly life insurance premium cost by state

- The average yearly health insurance premium cost by state

Based on U.S. Census reported data on health insurance coverage in the United States, just about half of the population receives health insurance coverage through their employer or a family member’s employer. We considered this and used both the average cost of health insurance with and without employee coverage to create an accurate estimate for the calculation.

Knowing this, we then used Census data of the median household income for every state to determine what percentage of income goes towards insurance in every U.S. state.

Key Findings

- Mississippians spend the most of their annual income on insurance at 11.20%, or $5,501.58 annually.

- Utah residents spend the smallest percentage of their income on insurance payments, at just 5.52%, or $4,368.76 annually.

- New Yorkers spend the most on insurance every year at about $8,084 towards auto, life, and health insurance.

- Residents in Idaho spend the least on insurance every year at about $4,168 for auto, life, and health insurance.

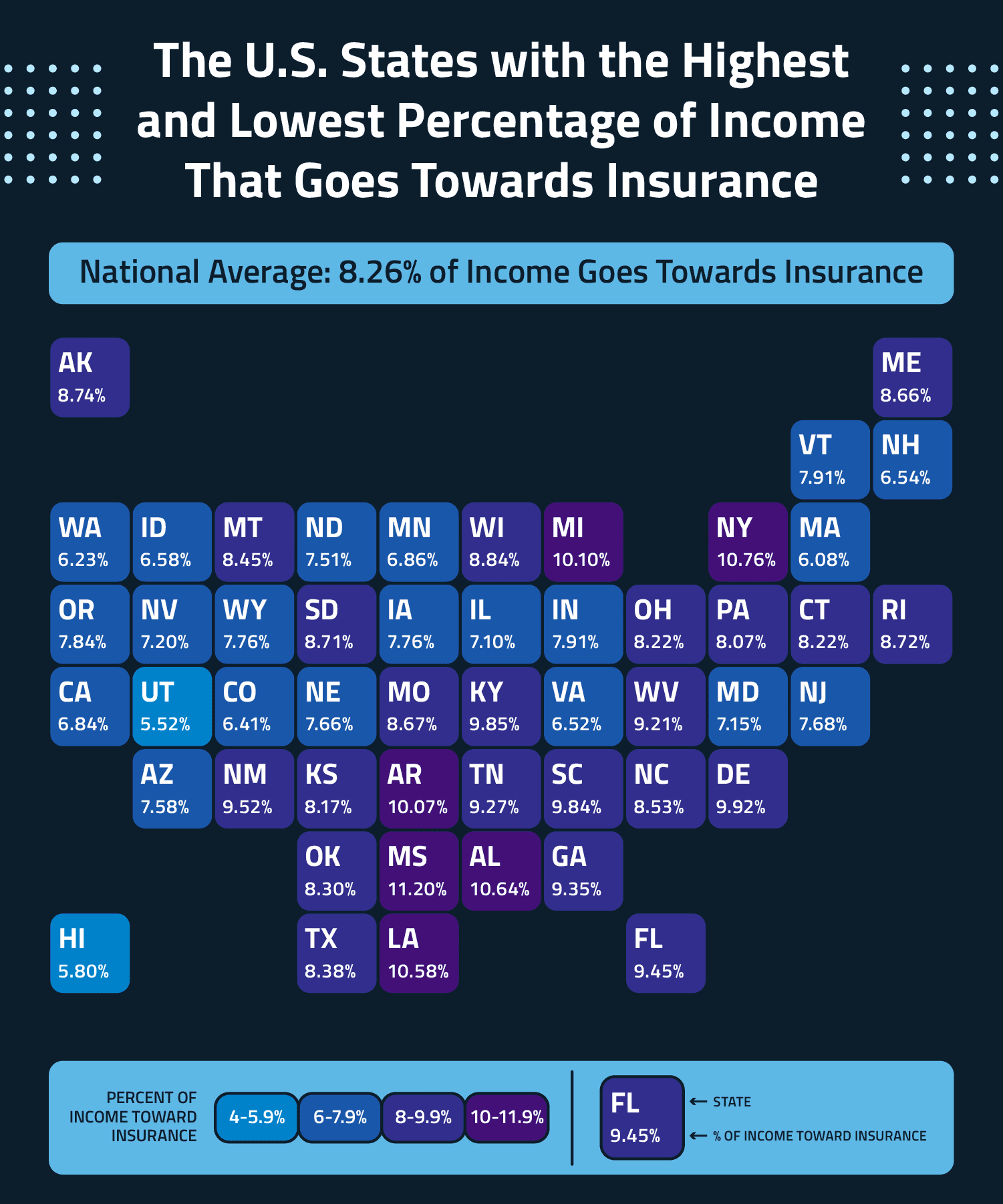

The U.S. States with the Highest and Lowest Percentage of Income That Goes Towards Insurance

The pandemic has highlighted the importance of having health insurance in recent years. However, it has also led to a chain reaction in which health insurers in individual marketplaces have raised their rates to offset expenses incurred by a higher number of policyholders seeking health services, as well as inflationary pressures.

For example, marketplace insurers are proposing 10% premium hikes in 13 states and D.C. in 2023. Nationally, Americans spend 8.26% of their annual income on insurance, but there are significant differences on a state-by-state level.

Mississippians have most of their yearly earnings go towards insurance payments on average at 11.20%, nearly 3% more than the national average. In Mississippi, the average yearly cost for car insurance is $1,939.08, and the average yearly life insurance cost is $581.00. The annual health insurance premium (employee contribution) is $1,653.00 and the annual average health insurance cost per private enrollee is $4,310.00

Utah is the state with the lowest percentage of their income that goes towards insurance payments at 5.52% on average. Utah’s average annual car insurance cost is $1,340.76 and their average annual life insurance cost is $636.00

New Yorkers spend the most on insurance every year at about $8,084 towards auto, life, and health insurance, which accounts for 10.76% of their income on average. Those living in New York pay an average yearly car insurance cost of $3,424.44 which is the highest across all the U.S. states. In addition, New Yorkers with private enrollment health insurance pay $6,264.00 on average. It is second only to Alaska’s average spending of $6,523.00.

Residents in Idaho spend the least on insurance every year at about $4,168 for auto, life, and health insurance. However, this still accounts for 6.58% of their income.

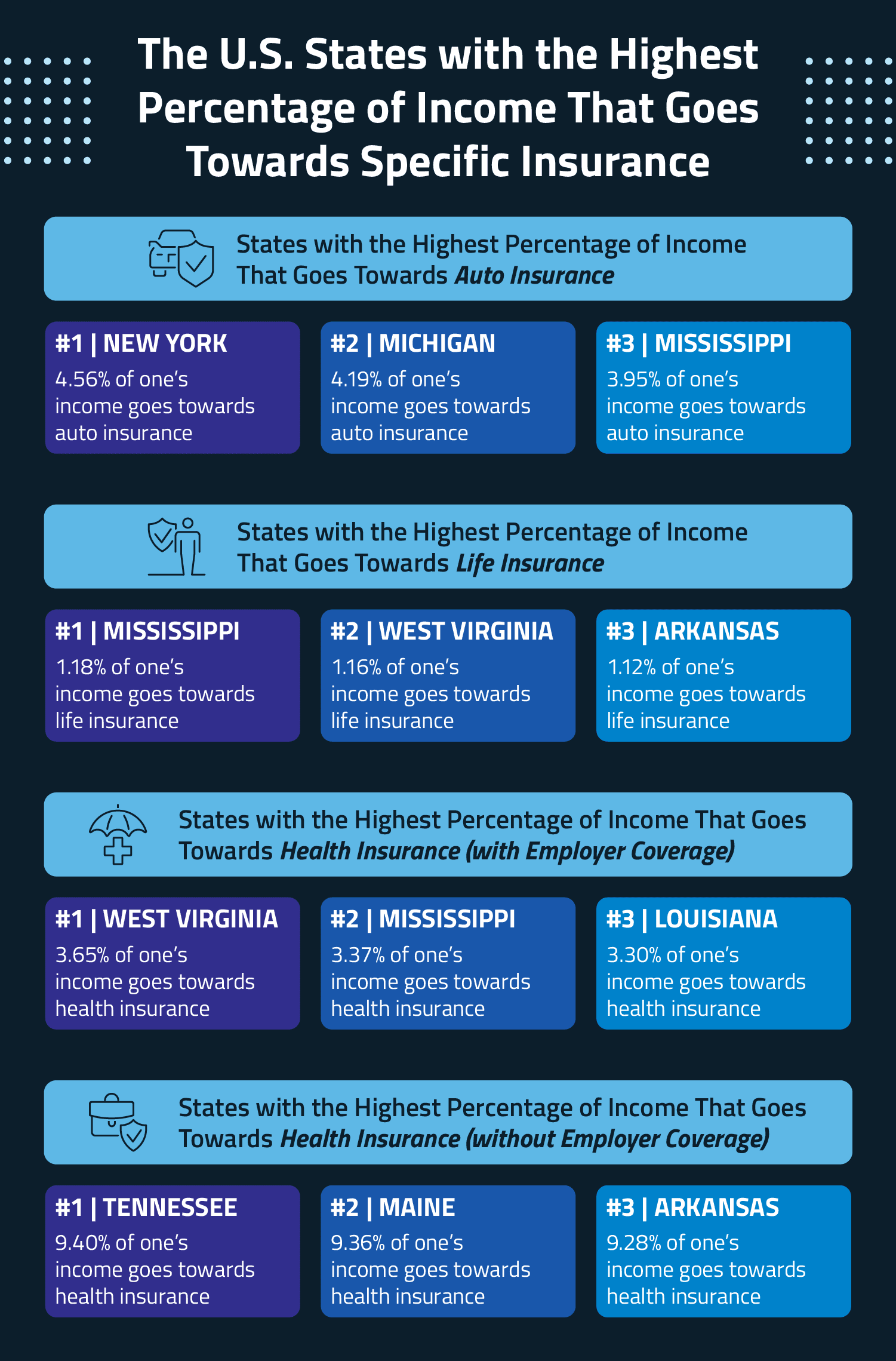

The U.S. States with the Highest Percentage of Income That Goes Towards Specific Insurance

Next, we zoomed in on the states with the highest percentage of income that goes toward specific insurance.

Mississippi ranks first, as the state with the highest percentage of income toward life insurance at 1.18%, second for health insurance (with employee coverage) at 3.37%, and third for auto insurance at 3.95%.

In addition, West Virginia places first as the state with the highest percentage of their income toward health insurance (with employee coverage) at 3.65% and second for life insurance at 1.16%.

Interestingly, West Virginia ranks 14th overall with 9.21% of their income that goes toward auto, life, and health insurance. This is because West Virginia has the second lowest monthly auto insurance premium of all the states at $72.17, or $866.04 annually.

Tennessee places first in the health insurance (without employee coverage) category with 9.40% of their income going toward health insurance. This amounts to $5,501.00 annually.

This is followed by Maine with 9.36% of their income going toward health insurance (without employee coverage) and Arkansas at 9.28%.

Full Data

Are you interested in diving deeper into the various insurance rates and costs within each state, or wanting to see how your state of residence stacks up if it’s not listed within the above map?

We’ve compiled our full data study for all 50 U.S. states analyzed into the interactive data table below. Search for the state you call home or click on the heading of each column to sort by category.

Closing Thoughts

Our study revealed the states with the highest percentage of income that goes toward insurance, as well as the lowest. We hope this study sheds light on the harsh reality facing many Americans today, many of whom are struggling to keep up with rising rates and premiums.

At Assurance IQ, we can help you shop for affordable life, auto, and health insurance plans that meet your needs by comparing quotes so you can find the right policies for you or your family.