One of the most sought-after employee benefits is health coverage. Though coverage comes in many forms, from partially subsidized to fully covered, the financial support offers employees relief from staggering healthcare costs. In this campaign, we delve into the U.S. states where employers are most likely to provide comprehensive health coverage for their employees.

The States with the Best & Worst Employer Health Insurance Coverage

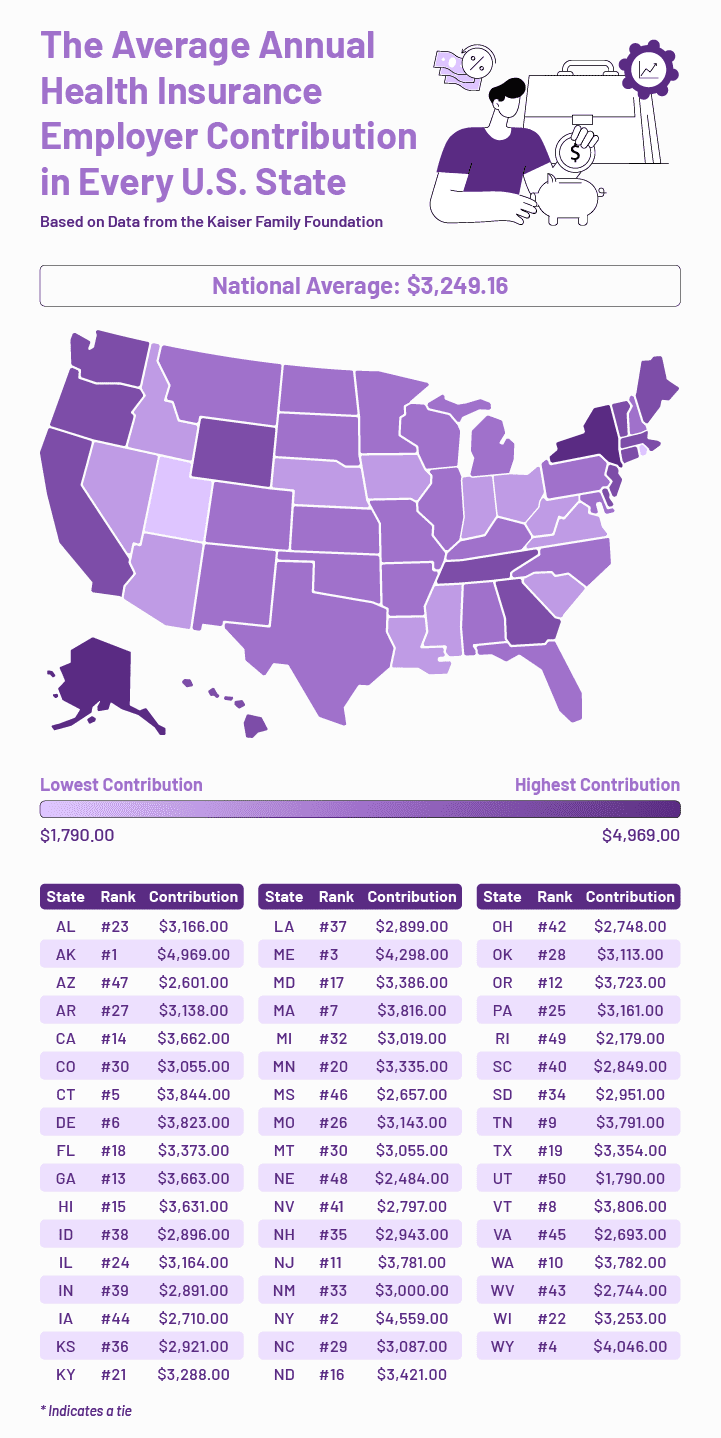

According to data from the Kaiser Family Foundation, some states provide much better employer-sponsored health coverage than others. The states at the top of the list — Alaska, New York, Maine, Wyoming, and Connecticut — offer employees significant savings on their annual health insurance premiums.

Alaska stands out as the state with the best coverage, with employees saving an average of nearly $5,000 annually on health insurance premiums. As healthcare expenses rise throughout the country, having access to this benefit can be significant for all employees, especially those with families. New York and Maine follow closely behind, with savings of $4,559 and $4,298 respectively.

On the other hand, employees in states like Utah, Rhode Island, Nebraska, Arizona, and Mississippi may struggle to find more affordable employer-sponsored health coverage, as the coverage in these states is significantly lower compared to the states at the top of the list. In Utah, for example, employees save an average of only $1,790 annually on health insurance premiums, which is less than half of what employees in Alaska save. Rhode Island, Nebraska, Arizona, and Mississippi also fall behind in terms of coverage, each saving their employees less than $3,000 per year on average.

This data highlights the importance of considering health benefits when evaluating job opportunities, as it can have a significant impact on an individual’s finances and overall quality of life.

Analyzing How Much Employees Value Health Insurance

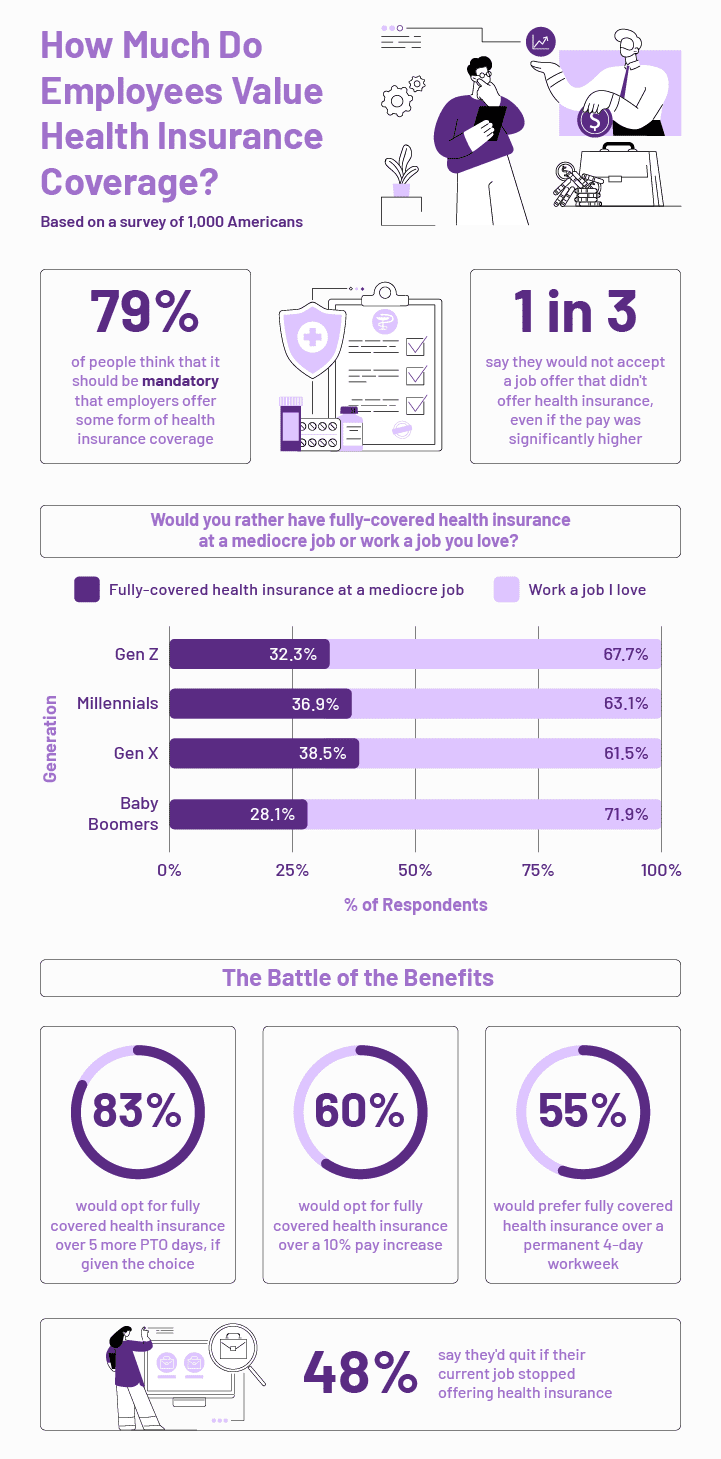

The survey data also provides insight into how workers weigh health insurance against other job benefits. When asked about a series of hypothetical trade-offs, the majority of respondents consistently opted for fully covered health insurance over other benefits, such as more PTO days or a pay increase. This suggests that for many workers, health insurance is seen as an essential benefit that cannot be easily substituted for other perks.

Ultimately, 79% of employees feel that health insurance coverage should be mandatory for employers in the United States. Similarly, one in three say they would not accept a job that did not offer health insurance coverage — even if the pay was substantially higher.

However, there were some differences in preferences based on demographic factors such as gender and industry. For example, females were 17% more likely than males to opt for a four-day workweek over fully covered health insurance. The employee’s industry also plays a role, as 66% of workers in the computer software industry say they would quit if their job stopped offering health insurance, compared to 48% of the general public.

One of the most significant findings of the survey is that despite the high value placed on health insurance coverage, almost half of respondents (48%) do not believe that the cost of health insurance is worth it. This highlights a larger problem with the affordability of healthcare in the United States and the need for solutions that make healthcare more accessible and affordable for all Americans.

Overall, the survey data shows that health insurance is a crucial factor in the job market, with many workers prioritizing access to affordable healthcare over other job benefits. Employers who want to attract and retain top talent will need to take this into account and ensure that they offer competitive health insurance benefits that meet the needs of their employees.

Closing Thoughts

In conclusion, this data emphasizes the significance of health insurance in the contemporary job market and the necessity for employers and insurers to offer accessible and reasonably priced coverage to all Americans. Employers who provide inclusive health insurance benefits are better positioned to recruit and retain top talent in the fiercely competitive job market.

Assurance IQ can help you find affordable health insurance that best meets your needs if you do not have employer-sponsored insurance or are interested in supplementing your existing coverage.

Methodology

To evaluate employer health insurance coverage around the U.S., we first analyzed the amount employees are saving based on the average cost of health insurance and the average employer contribution in every U.S. state, based on data from the Kaiser Family Foundation.

Additionally, we conducted a nationwide survey of 1,000 respondents in April of 2023 to ask questions about their feelings and perceptions toward health insurance coverage.