More Americans were insured in 2021, compared to 2020, according to data published by the U.S. Census Bureau. Roughly 28.3 million people did not have health insurance in 2020 compared to 27.2 uninsured Americans in 2021. COVID may have played a major role in consumers’ demand for both health and life insurance, as U.S. life insurance application activity increased by 3.4% in 2021. While there are many different types of insurance, this renewed urgency on protecting both yourself and your loved ones has turned the spotlight back on Americans’ insurance habits.

From insuring pets to purchasing travel and auto insurance, we wanted to see which residents were the most insured and how much they spent on insurance on a state-by-state level. We surveyed over 2,000 Americans in hopes that our findings reveal the importance of purchasing insurance for all facets of life — from health to home to auto — and everything in between. Keep reading to learn more.

Key Findings

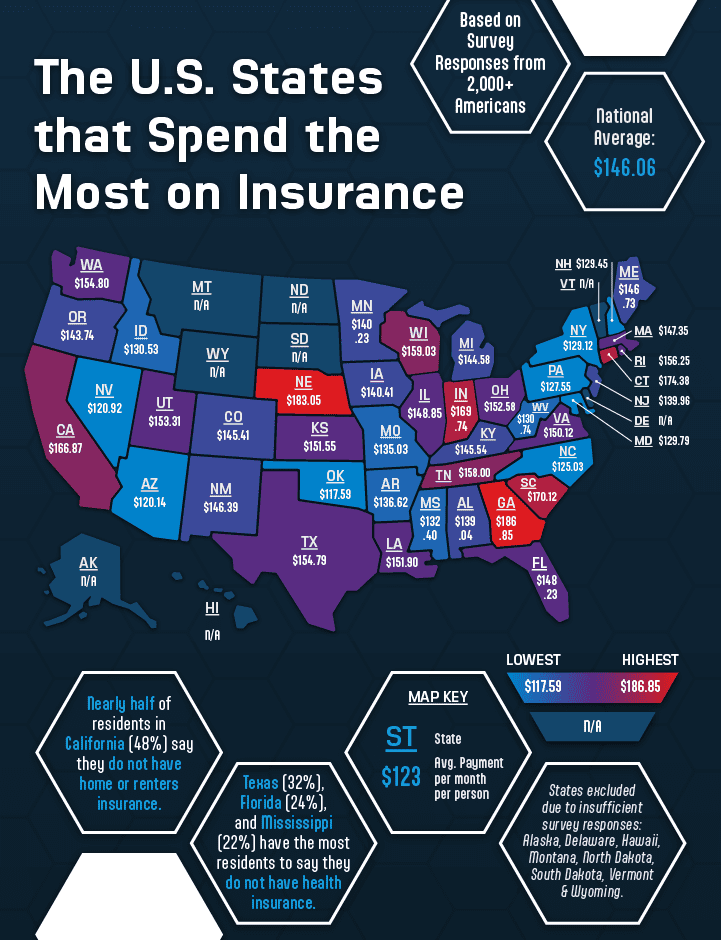

- Residents in Georgia are paying the most on average for insurance at $186.85 per person per month.

- Residents in Oklahoma are paying the least on average for insurance at $117.59 per person per month.

- Men (17%) are more likely than women (14%) to say they do not have auto insurance.

- A majority of Americans (77%) say they would rather give up auto insurance than health insurance if they had to choose.

- Millennials (26%) are more likely than other generations to give up health insurance instead of auto insurance.

Monthly Spending on Insurance by State

The value of paying for different types of insurance like health or auto is often not fully realized until you need it. In this survey, we asked Americans what kind of insurance they have, how much they spend each month on it, and what types of insurance they cannot live without.

States like Oklahoma ($117.59), Arizona ($120.14), Nevada ($120.92), North Carolina ($125.03), and Pennsylvania ($127.55) spend the least amount of money on insurance monthly.

On the opposite end of the spectrum, states like Georgia ($186.85), Nebraska ($183.05), Connecticut ($174.38), South Carolina ($170.12), and Indiana ($169.74) spend the most on monthly insurance payments, on average.

There is a difference in how states value different types of insurance, such as pet, home, and health insurance.

States like Georgia (12%), Tennessee (12%), and South Carolina (12%) have the most residents who report having pet insurance. Insuring pets is a personal decision, but it’s estimated that owning a dog can cost anywhere from $1,400 to $4,300 per year, making pet insurance a wise financial decision for some.

Interestingly, nearly half of the residents in California (48%) say they do not have home or renters insurance. Climate change issues like wildfires, mudslides, and flooding in the state of California are expected to raise home insurance premiums, which could be one reason why nearly half of the residents don’t have home or renters insurance.

When it comes to health insurance, Texas (32%), Florida (24%), and Mississippi (22%) have the most residents who say they do not have it.

We also found that overall, more than half of the country (56%) says they do not have life insurance. Some companies do provide life insurance packages, but obstacles like affordability could lead to more uninsured Americans.

When looking at Americans’ insurance habits across demographic cohorts, we discovered patterns within certain generations.

Gen Z (9%) and Millennials (7%) are more likely than older generations to have pet insurance while Baby Boomers (20%) are more likely than younger generations to routinely buy travel insurance when traveling.

We also found that Baby Boomers (84%) are more likely than younger generations to give up auto insurance and keep health insurance.

Having good insurance can provide a safety net for when you need it most, but that still doesn’t stop one in two Americans (55%) from thinking they spend more on insurance than the return they get on it.

Closing Thoughts

Deciding what type of insurance to buy and how much to spend can be a challenge. At Assurance IQ, we can help you find the right insurance home insurance or auto insurance policy to secure your financial future and protect your loved ones.

Methodology

To discover Americans’ attitudes toward insurance, we surveyed over 2,000 participants. Our survey ran for two weeks in January 2023. We asked questions about which types of insurance Americans had, how much they paid for coverage, and more. Due to not having enough survey respondents, the following states were not included in our final results: Alaska, Delaware, Hawaii, Montana, North Dakota, South Dakota, Vermont, and Wyoming.