Medicare could help you pay for a wide range of routine and unexpected healthcare services, but it doesn’t cover 100% of medical bills. Medicare Supplement Insurance, also known as Medigap, is a private insurance option that’s designed to help pay for Original Medicare’s costs, such as deductibles and coinsurance for either Medicare Part A or Part B, or both. As of 2019, nearly 4 in 10 people with Original Medicare were enrolled in Medigap.

In most states, there are 10 standardized Medigap plans to choose from. Each standardized plan covers a different set of benefits, so you can choose an option that suits your needs. Learn what to consider when choosing a Medigap policy.

Table of Contents

Key Factors in Choosing a Medigap Policy

There are 10 Medigap plans available in most states. These federally standardized plans are identified with the letters A, B, C, D, F, G, K, L, M, and N. Each plan with the same letter covers the same benefits, no matter which insurer sells it.

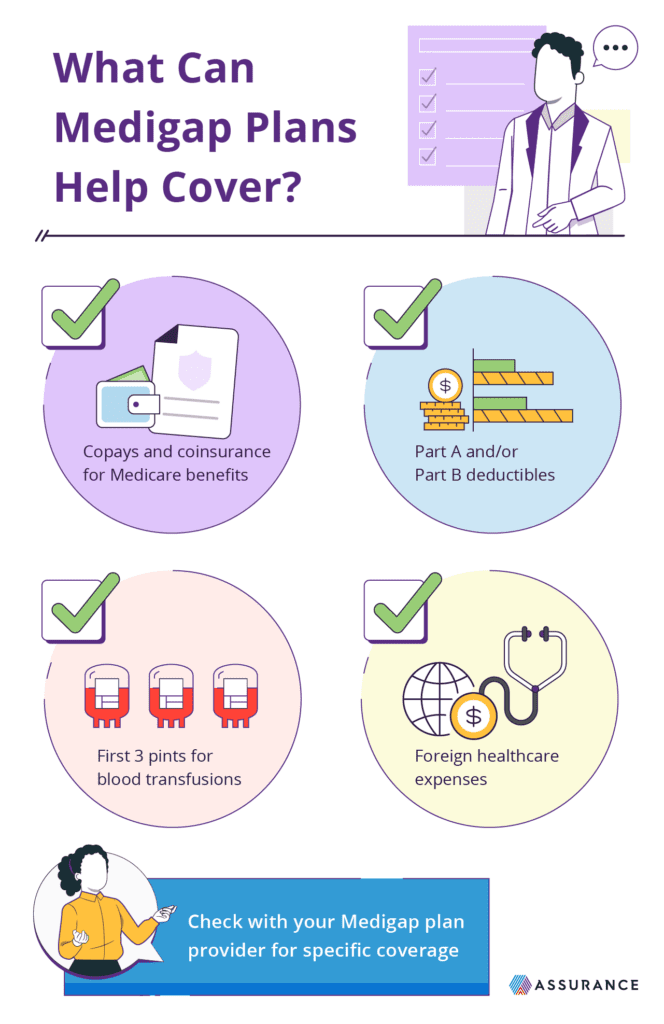

Every Medigap policy helps cover the following out-of-pocket costs in Medicare:

- Part A coinsurance

- Up to 365 additional lifetime reserve hospital days

- Part B coinsurance or copays

- First 3 pints of blood

- Part A hospice coinsurance or copays

Some of the 10 standardized policies also include coverage for:

- Skilled nursing facility coinsurance

- Part A deductible

- Part B deductible (for people who were Medicare-eligible before Jan. 1, 2020)

- Part B excess charges

- Foreign travel emergency care

When choosing a Medigap policy, consider both your budget and which healthcare services you’re likely to need, now or in the future. Keep in mind that plans that cover more out-of-pocket costs tend to have higher premiums, while those that cover fewer costs tend to have lower premiums.

In three states — Massachusetts, Minnesota, and Wisconsin — Medigap plans are standardized differently. If you live in one of these states, you can choose from the following standardized plans instead of Plans A through N:

- Massachusetts: Core Plan, Supplement 1 Plan, or Supplement 1A Plan

- Minnesota: Basic Plan or Extended Basic Plan

- Wisconsin: Basic Plan, 25% Cost-Sharing Plan, 50% Cost-Sharing Plan, or High-Deductible Plan

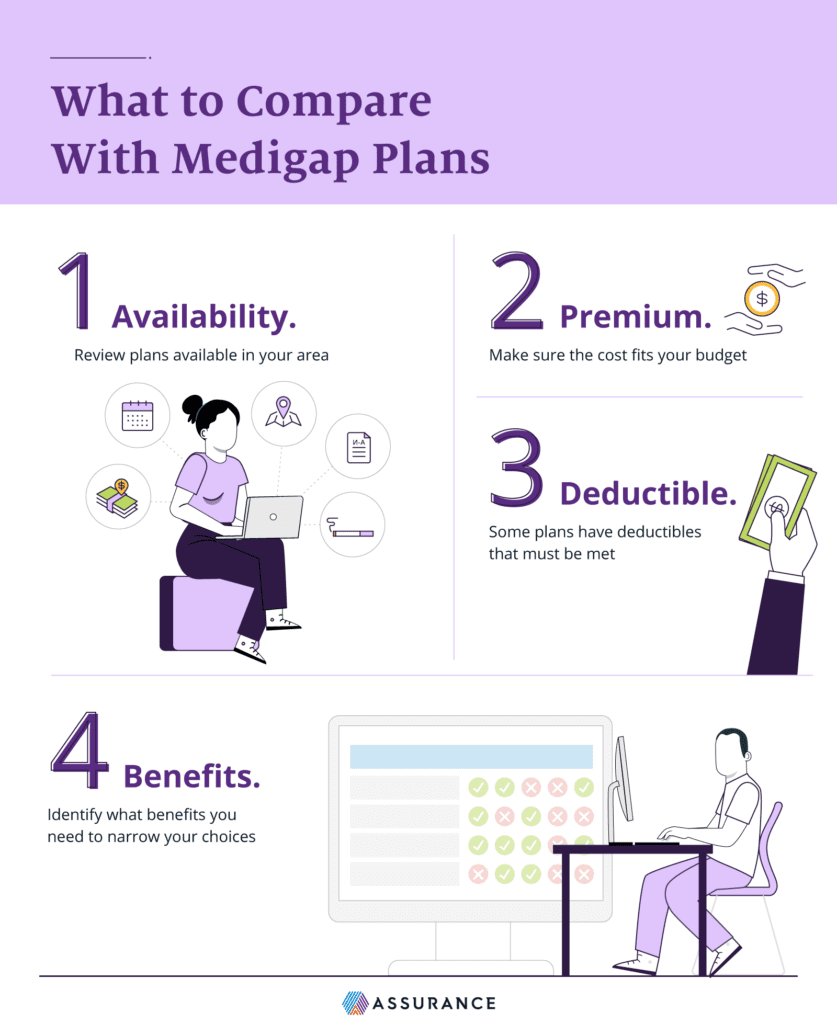

Consider Your State’s Medigap Plan Regulations and Availability

While the 10 standardized Medigap policies are available in most states, actual plan availability may vary depending on where you live, how old you are, and when you became eligible for Medicare. In addition, insurers that sell Medigap policies are not required to offer all 10 plan types, and three states offer different Medigap plans altogether.

Under federal law, any insurer that offers Medigap at all is required to offer a Plan A option, as well as either Plan C or Plan F, though enrollment in these plans is limited to people who were eligible for Medicare before January 1, 2020. Aside from those mandatory options, insurers may choose to offer some or all of the other 7 standardized plans if those plans can be sold in your state.

Those udner 65 years old with Medicare may not be able to find Medigap plans in every state, as only 33 states mandate that Medigap insurers at least one policy option to younger beneficiaries. However, some states may provide this protection to those under 65 with an eligible disability or End-Stage Renal Disease.

Medigap plan choices are different for Massachusetts, Minnesota, and Wisconsin residents. Each of these states has its own set of standardized Medigap plans, which may cover certain state-mandated benefits in addition to out-of-pocket Medicare costs. For example, in Massachusetts, Medigap plans must cover Pap tests and mammograms. If you live in one of these states, be sure you understand your different coverage options.

Consider Your Budget and Medigap Plan Costs

The cost of Medigap coverage can vary depending on the standardized plan you choose and the plan’s insurance company. When evaluating plan costs, think about the monthly premiums as well as the potential reduction in out-of-pocket Medicare expenses.

The monthly premium is the amount you pay each month to keep your Medigap policy active. Medigap plans that cover fewer out-of-pocket costs tend to have lower monthly premiums, while you can expect higher premiums for plans that cover more out-of-pocket costs.

Different insurance companies may charge different prices for the same coverage, too. For example, Plan A from one company may cost more than Plan A from another company. Insurance companies can also use different methods to set their premiums, which can affect how your costs change as you get older. Before buying a policy, be sure to find out which pricing method the company uses:

- Community-rated: The monthly premium is the same for each person with the Medigap policy, regardless of their age.

- Issue-age-rated: The monthly premium is set based on a person’s age when the policy is issued and doesn’t increase based on age.

- Attained-age-rated: The monthly premium is set based on a person’s current age and may increase automatically as they get older.

It’s also important to think about the potential reduction in your out-of-pocket Medicare expenses. With your current and anticipated health needs in mind, estimate how much each Medigap plan could reduce your Medicare deductibles, copayments, and coinsurance based on how often you would need to utilize covered services. These calculations can be complex, so you may want to talk to a trusted licensed insurance agent for help comparing overall plan costs.

Consider Your Healthcare and Health Services Needs

Since each standardized Medigap plan covers a different set of out-of-pocket Medicare costs, it’s important to take your health needs into account when choosing a Medigap policy. You may not be permitted to switch Medigap policies later, even if your health changes. For this reason, it’s essential to consider not only your current health routine, but also your anticipated needs when evaluating policy options.

Consider your typical healthcare usage. If you’re in good health and rarely need to see a doctor, a Medigap plan that covers fewer benefits could be sufficient. On the other hand, if you have a chronic disease or serious health condition, a Medigap plan that covers more out-of-pocket costs may be preferable to help keep costs down.

Your family medical history can provide clues about the health conditions you might develop in the future so you can better anticipate the level of coverage you may need from a Medigap plan. For example, if you have a family history of heart disease, you may want to plan for a future where you could also require treatment and management for heart disease.

Medigap Plan Options

Benefits | Plan A | Plan B | Plan C | Plan D | Plan F | Plan G | Plan K | Plan L | Plan M | Plan N |

|---|---|---|---|---|---|---|---|---|---|---|

Part A coinsurance and hospital costs for up to 365 additional days after Medicare benefits are disbursed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Part B coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | 100% coinsurance; but copays may still apply |

Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

Part A deductible | Not covered | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

Part B deductible | Not covered | Not covered | Yes | Not covered | Yes | Not covered | Not covered | Not covered | Not covered | Not covered |

Part B excess charge | Not covered | Not covered | Not covered | Not covered | Yes | 100% | Not covered | Not covered | Not covered | Not covered |

Out-of-pocket limit | N/A | N/A | N/A | N/A | N/A | N/A | $6,940 in 2023 | $3,470 in 2023 | N/A | N/A |

Blood (first three pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

Skilled nursing facility care coinsurance | Not covered | Not covered | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

Foreign travel exchange up to plan limits | Not covered | Not covered | 80% | 80% | 80% | 80% | Not covered | Not covered | 80% | 80% |

How to Enroll in Medigap

Generally, the best time to enroll is during your Initial Enrollment Period for Medigap. This period is a 6-month window that begins when you’re 65 or older and enrolled in Medicare Part B. It is non-repeatable, so remember to mark this period on your calendar. During this time, insurers are required to sell you a policy even if you have health problems, and cannot charge you more than a healthy individual.

You may buy a Medigap policy outside of this period if you miss your Initial Enrollment Period. However, there may be fewer plan options and higher costs and insurers can generally require applicants to complete a health questionnaire. If you have health issues, insurers may charge higher premiums or even decline your application.

Medigap is only available to people who are enrolled in both Part A and Part B of Original Medicare. It does not work with Medicare Advantage, a private alternative to traditional Medicare. People with Medicare Advantage can only buy a Medigap plan if they are switching back to Original Medicare.

In some special situations, insurance companies are required to sell a Medigap policy without considering your pre-existing health conditions. For instance, you may have a right to buy a Medigap policy if you move out of your Medicare Advantage plan’s service area and decide to go back to Original Medicare. It is important to understand your options before your initial enrollment period comes so you can make the best decision for your healthcare needs.