How Much Does Medigap Cost?

Medigap costs depend on whether the insurer uses community-rated, issue age-rated, or attained age-rated premiums, and whether you select a higher or lower coverage plan. Unlike Original Medicare, which the federal government runs, Medigap plans are offered by private companies. However, they are federally standardized and subject to state regulations.

Learn more about how to determine your Medigap costs, and what you can expect to pay for your coverage alongside Original Medicare.

Table of Contents

What Is Medigap?

Medigap, also known as Medicare Supplement insurance, is designed to help fill the gaps in Original Medicare by covering certain out-of-pocket healthcare expenses. While Original Medicare covers many health costs, depending on your needs and frequency of care, it may not be enough to keep your healthcare affordable. Medigap, an optional plan that works to supplement your Original Medicare enrollment, can help pay some of the copayments, coinsurance, and deductibles associated with Medicare.

Different Medigap plans provide varying levels of coverage for these out-of-pocket expenses. For example, Medigap Plan A offers minimal coverage but also boasts the lowest premium, which is ideal for those who want help paying for Medicare expenses but do not necessarily need comprehensive coverage. Your selected plan, as well as when you enroll and how your insurer determines its premiums, all affect how much you would pay for Medigap.

Why Get Medigap?

Paying for a Medigap plan may seem counter to spending less on your Medicare coverage, but the benefits of Medicare supplement insurance could help you save money in the long run. For example, there are no out-of-pocket maximums with Original Medicare. If you need numerous or costly procedures, your copays and coinsurance could climb without limit, even with Medicare coverage.

However, a Medigap plan may include an out-of-pocket maximum that can help restrict how much you spend on Medicare-approved healthcare. Once you reach your Medigap plan’s out-of-pocket maximum, your plan will pay for the remainder of your Medicare costs until the following year.

A trusted insurance agent can help you estimate how much your healthcare coverage may cost with and without Medigap. This information can help you decide which Medigap plan best fits your needs and budget.

Medicare provides an array of benefits, but it also come with an 80/20 cost-sharing arrangement. A Medicare Supplement plan can help cover the remaining 20% of the cost. This additional coverage can be especially beneficial for individuals who require frequent visits to doctors, particularly specialists.

Medicare Supplement plans can help cover copays, deductibles, and other out-of-pocket expenses, reducing the financial strain on individuals with high healthcare needs. However, it’s crucial to compare different plans and their associated costs to select one that aligns with your budget and coverage requirements.

Factors That Influence How Much Medigap Plans Cost

There are five main things that determine how much your Medigap coverage will cost:

- Where you live

- Your selected plan

- Your insurer’s pricing model

- When you enroll

- Your tobacco usage

Look into what each of these factors mean and how it can cause your Medigap premium to increase or decrease.

Where You Live

Insurers take regional healthcare costs into account when setting Medigap premiums. This means plans in areas with higher overall healthcare costs will likely have higher premiums. In addition, each state has its own regulations governing Medigap policies, which can influence the cost of coverage.

For example, Massachusetts, Minnesota, and Wisconsin have their own standardized Medigap plans, which differ from the federal standard plans available in other states. For example, all insurers in Massachusetts must offer specific core benefits in their Medigap plans alongside any additional benefits. These state-specific plans can impact pricing and plan options for residents.

Your Selected Plan

Benefits | Plan A | Plan B | Plan C | Plan D | Plan F | Plan G | Plan K | Plan L | Plan M | Plan N |

|---|---|---|---|---|---|---|---|---|---|---|

Part A coinsurance and hospital costs for up to 365 additional days after Medicare benefits are disbursed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Part B coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | 100% coinsurance; but copays may still apply |

Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

Part A deductible | Not covered | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

Part B deductible | Not covered | Not covered | Yes | Not covered | Yes | Not covered | Not covered | Not covered | Not covered | Not covered |

Part B excess charge | Not covered | Not covered | Not covered | Not covered | Yes | 100% | Not covered | Not covered | Not covered | Not covered |

Out-of-pocket limit | N/A | N/A | N/A | N/A | N/A | N/A | $6,940 in 2023 | $3,470 in 2023 | N/A | N/A |

Blood (first three pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

Skilled nursing facility care coinsurance | Not covered | Not covered | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

Foreign travel exchange up to plan limits | Not covered | Not covered | 80% | 80% | 80% | 80% | Not covered | Not covered | 80% | 80% |

For most states, Medigap plans are lettered A through N, and all plans with the same letter must offer the same level of benefits no matter which insurer offers it. Plans with less coverage typically cost less, while more comprehensive plans usually have higher premiums.

It should be noted that Plans C and F are no longer available to those who became eligible for Medicare after January 1, 2020. However, if you already have one of these plans or were eligible for Medigap before 2020 and had no yet enrolled, you may still purchase Plan C or F.

Your Insurer’s Pricing Model

Insurers may utilize one of the following pricing models to set Medigap premiums:

- Community rated: With this method, the insurance company charges the same premium for all policyholders, regardless of their age. Premiums are based on the average cost of providing coverage for the entire community. As a result, younger enrollees might pay more than they would under other rating methods, while older enrollees may pay less. Community-rated premiums may still increase over time due to inflation or other factors, but they will not increase due solely to your age.

- Issue age-related: Under this method, the premium you pay depends on the age at which you first purchase the policy. The younger you are when you buy the policy, the lower your premium will be. This method is beneficial for those who enroll in a Medigap plan as soon as they are eligible, as their premiums will be lower and will not increase due to age. However, premiums can still increase over time due to inflation, changes in healthcare costs, or other factors unrelated to age.

- Attained age-related: With this rating method, premiums are based on your current, or attained, age. This means that your premiums will start lower when you are younger but will increase as you get older. Although attained-age-rated premiums may initially be more affordable, they can become significantly more expensive over time, especially for older enrollees. Like the other methods, premiums can also increase due to factors such as inflation or changes in healthcare costs.

Some states also require insurers to utilize a specific pricing model. For example, all Medigap plans in New York must be community rated.

When You Enroll

Unlike other Medicare plan types, you can enroll in Medigap year round instead of adhering to enrollment periods. However, there is one enrollment window to pay attention to: your Initial Enrollment Period, which is different from your initial Medicare enrollment window. The Medigap Initial Enrollment Period begins three months before you are 65 years old and also have Medicare Part B coverage, until three months after your birthday. For example, if you are of eligible age and your Part B coverage begins June 1, your Medigap Initial Enrollment Period would run from June 1 until November 30.

During the Medigap open enrollment period, you can purchase any Medigap policy sold in your area, regardless of your health status. Insurers must also offer all applicants the same premium rate as someone who is healthy.

Options Outside of Initial Enrollment Period

If you miss your initial enrollment window, you do not have to wait for another enrollment period to apply for a policy. You may apply at any time throughout the year. However, outside of your Medigap Initial Enrollment Period, your plan will likely cost more because insurance companies can base premiums on your current or past health history, or deny coverage altogether.

Some states have their own enrollment periods that may allow you to enroll later or make changes to your policy without incurring increased premiums or coverage denials. An example of this is the Medigap birthday rule, where you can enroll around your birthday each year without a medical screening. In California, this period lasts 60 days after your birthday.

However, even with a higher premium, you may find that the right Medigap policy can help you with your Original Medicare expenses.

Your Tobacco Usage

If you sign up for Medigap during your Initial Enrollment Period, your tobacco usage will not affect your premium because you must be offered the same rate as someone who is healthy regardless of your health status, including your tobacco usage.

But outside of that period, you will likely pay more for coverage than someone who does not use tobacco products at all.

Medigap Cost Comparison Charts

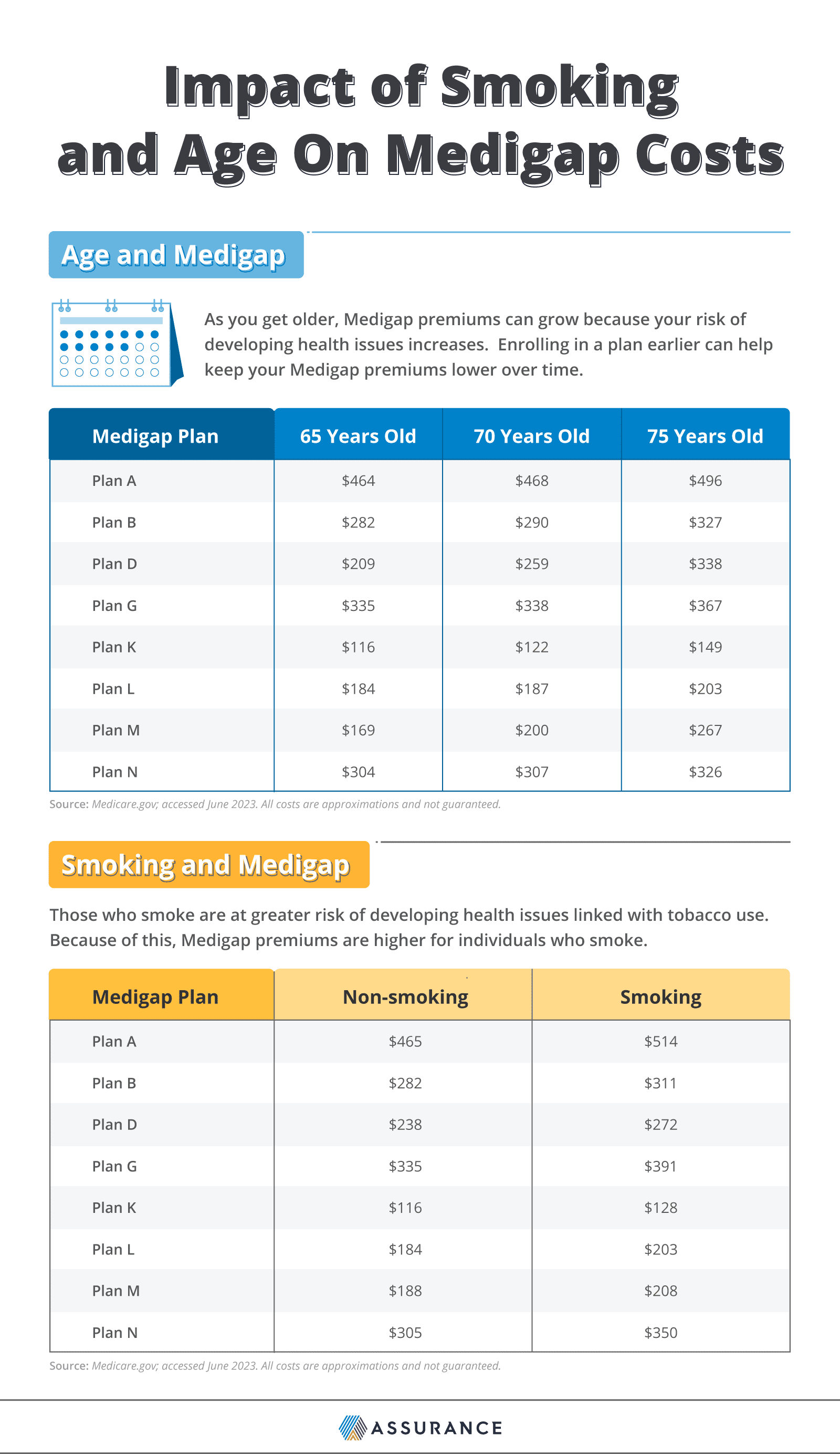

To give you an idea of how some factors impact costs, consider the comparisons below. All examples are average monthly premiums for a non-smoking male Medigap beneficiary in Texas unless otherwise noted. These costs are not guaranteed and will vary based on your own individual details.

These numbers are the average monthly premiums for a non-smoking male in Texas and the average monthly premiums for a 68-year-old male in Texas.

Discounts and Programs for Lowering Medigap Costs

The best way to get the most favorable Medigap premium is to enroll during your Initial Enrollment Period, as during this time you would have access to all plans available in your state at the same rate as a healthy individual regardless of your health status and pre-existing conditions. This is also known as a guaranteed issue right.

But even outside of the Initial Enrollment Period, there are other ways to lower potential Medigap premiums.

Open Enrollment Periods and Birthday Rules

Some states have recurring open enrollment periods where eligible individuals can switch Medigap plans or enroll anew without undergoing medical underwriting, though what kind of plan you may enroll in may be subject to limitations. For example, you may only be allowed to change from an existing plan to another during this period without undergoing medical underwriting.

These enrollment periods may be the same window of time for every resident within that state, or differ based on your birthday or enrollment anniversary. For example, the following states observe an annual enrollment window based on your birthday:

State | Birthday Rule Enrollment Period |

|---|---|

30 days from birthday to change to a different Medigap plan with similar or fewer coverage | |

63 days from birthday to change to a different Medigap plan with similar or fewer coverages | |

60 days from your birthday to change to a different Medigap plan with the same or fewer coverages | |

45 days after your birthday to change to any plan offered in the state with the same or fewer coverages | |

61 days, starting from the first day of your birth month to change to a different Medigap plan with similar or fewer coverages | |

31 days, beginning on your date of birth to change to a different Medigap plan with similar or fewer coverages |

By skipping medical underwriting, you can avoid paying more for coverage as you age and your health status changes.

Household Discount and Other Discounts

If you live with someone who has a Medigap policy from the same insurance company as you, you may be eligible for a household discount on your premiums. As these discounts vary based on insurer, criteria can differ but generally you must live in the same household as the other person who also has a Medigap policy with that insurer — such as if you and your spouse both have a Medigap policy from the same insurance company. Discounts are a percentage off the premium, typically ranging from 7-15% off.

Some insurance companies may also offer discounts for:

- Those who opt for electronic billing over paper billing

- Those who do not use tobacco

- Those who pay annually instead of monthly

Check with your insurance company to see what discounts are available to you.

How to Compare Medigap Plans and Enroll

There is more to choosing a Medigap plan than considering the premium prices. In addition, consider what you need your plan to cover, your available options, and take advantage of the “free look” period.

- Assess your needs. Consider your current and future healthcare needs, and which Original Medicare benefits you are likely to use. For example, suppose you plan to undergo major surgery in the upcoming year. In that case, you will need to meet your Part A deductible, then pay your portion of the Part A coinsurance once your benefits kick in. Some Medigap plans offer partial or complete coverage of the Part A deductible, and all provide some coverage of Part A coinsurance, helping lower overall care costs.

- Determine what plan type(s) would work best for you. Based on your needs assessment, look over what each plan type in your state covers. From there, narrow your options down to the types that would provide the most coverage for the services you will likely access.

- Consider your planned budget. Compare premium costs and how each plan will cover planned health services to determine which ones would save you the most money. Be sure to take deductibles, copays, and coinsurance into account in addition to the monthly premium to get the most comprehensive picture.

- Factor in the company’s overall reputation. Look into the company’s reviews and customer testimonials, or ask the opinions of those you trust about their experiences with your final choices.

- Enroll in your plan of choice. Consider whether it is better to enroll immediately or wait until the next open enrollment period if your state has one. In both cases, you will need to have your Medicare card and information ready when you enroll.

Taking a close look at your anticipated out-of-pocket costs for Original Medicare can help you calculate which Medigap plan may most effectively help you reduce those costs. While you can do this on your own, you may also work with a trusted licensed agent to help find or switch Medigap plans.

Medigap “Free Look” Period

If you are enrolling to change Medigap plans, take advantage of the Medigap “free look” period. This period lasts for 30 days after your new policy takes effect, and allows you to keep both policies active at the same time while you determine whether or not to commit to changing policies.

If you change your mind, you may return to your old policy without applying anew. Be sure to not cancel your old policy until you feel confident that you would like to keep the new policy.

Putting It All Together

Medigap can help you reduce your out-of-pocket costs from Original Medicare. While it may seem counterintuitive to pay another premium to save money, Medigap’s coverage of deductibles, copays, and coinsurance can make up what you would pay in monthly premiums. When determining how much you can expect to pay for your Medicare Supplement insurance, consider where you live and when you will enroll. If you are enrolling outside of your Initial Enrollment Period, expect for your health, age, and insurance pricing model to affect your premium.