With the possibility of an economic recession in the near future, Americans are understandably concerned about the potential financial impact. As a result, many are taking proactive steps to prepare. Insurance is about protecting yourself against risk and potential losses. Planning for a recession functions in much the same way, where savvy planners can manage their financial risk by curbing their spending, paying off credit card debt, and boosting their emergency saving funds. Recession planning can help provide a cushion in the event of an economic downturn. So what exactly are Americans doing to plan for a recession?

To find out, we polled 3,200 U.S. adults to gather insights on how individuals across the country are preparing themselves financially for a possible recession. We ask about current financial preparedness, savings to fall back on, and which types of spending will be cut first. Read on to see what we uncovered.

Table of Contents

Key Findings

- Most Americans (43%) feel financially ill-prepared if the U.S. were to fall into a recession this year. 30% feel prepared and 27% feel neither prepared nor ill-prepared.

- Over 60% of Americans say they’re taking the threat of a recession seriously in 2023.

- 56% of Americans claim they began saving when the possibility of a recession first came to light last year. 68% of Americans are cutting back on non-essential expenses, such as dining out, entertainment, and clothing items with the threat of recession looming.

- 23% of Americans would not have any savings to fall back on if they lost their job tomorrow due to a recession.

- Over a third of Americans (35%) will hold off on buying a house in 2023 in anticipation of a recession. 43% of millennials, in particular, are doing the same.

- When asking respondents how they’re planning for a recession, cutting discretionary spending, building an emergency fund, adding another revenue stream through a side hustle, and paying off credit card debt were the top responses.

The State of Financial Preparedness Pre-Recession

We asked people from each state to rate their level of financial preparedness in the event of a potential recession on a scale of 1 to 5, where 1 indicates feeling very ill-prepared and 5 indicates feeling very prepared. In the context of the study, feeling financially ill-prepared means failing to have an emergency savings fund that can cover three to six months of expenses in the event of unexpected job loss and having large amounts of high-interest credit card debt.

Hover over each state in the map above to see each state’s level of financial preparedness. The most and least financially-prepared states are as follows:

States Where Residents Feel Most Financially Prepared

- South Carolina

- Oregon

- Ohio

- Indiana

- New Hampshire

States Where Residents Feel Least Financially Prepared

- Oklahoma

- Arkansas

- Louisiana

- Texas

- Virginia

Overall, we found that 2 out of every 5 Americans would feel financially ill-prepared if the U.S. fell into a recession this year, suggesting that a significant portion of the population may be vulnerable to financial instability and uncertainty.

Furthermore, our survey revealed that baby boomers feel the most prepared in the wake of a recession. Over 43% of baby boomers reported feeling either prepared or very prepared for a potential recession, which is significantly higher than the 30% of Gen X and millennial respondents who reported feeling the same. In general, baby boomers reported feeling nearly 40% more prepared than their younger counterparts.

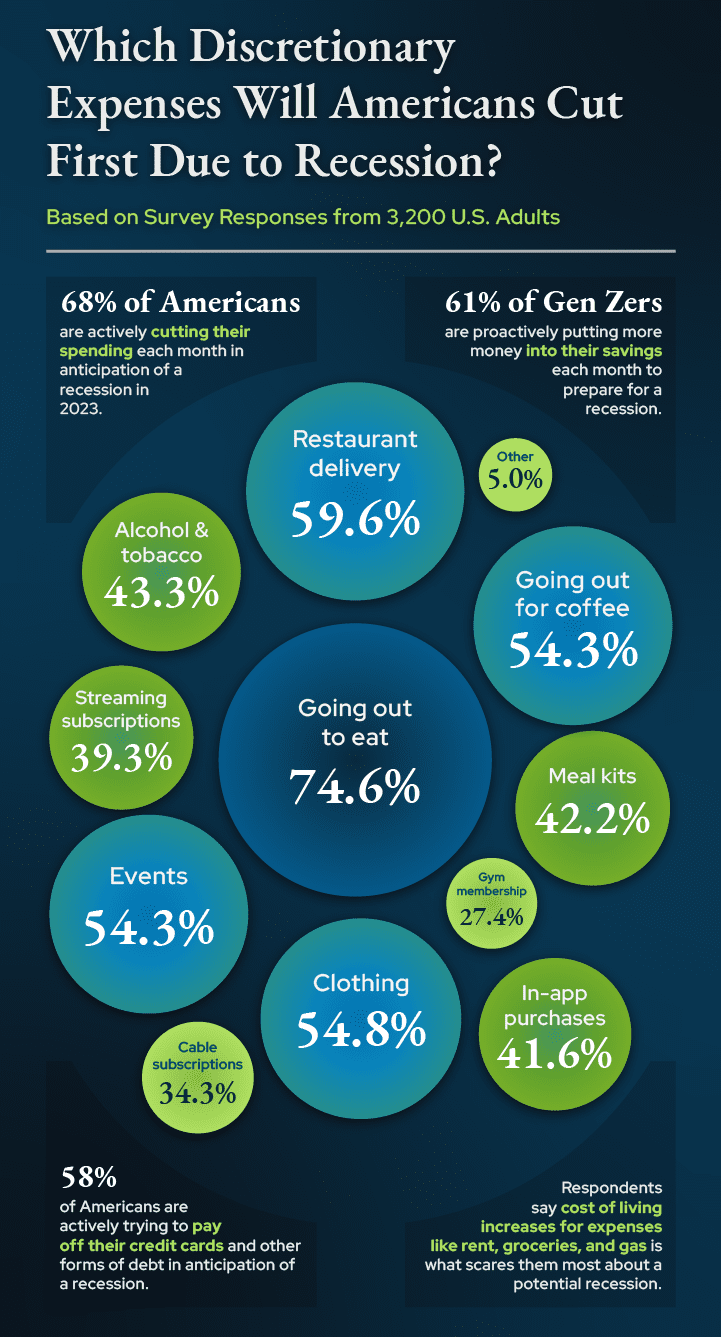

Which Discretionary Expenses Will Americans Cut First?

To prepare for a potential recession, many Americans are taking a cautious approach and prioritizing saving and debt reduction over discretionary expenses.

According to our findings, many Americans are actively preparing for a potential recession in 2023 by making changes to their daily spending habits. When asked which discretionary expenses they will cut first, going out to eat (75%), restaurant delivery from platforms like DoorDash and Grubhub (60%), and clothing purchases (55%) were the top responses.

61% of Gen Zers are taking proactive steps to increase their monthly savings, while 58% of Americans overall are focusing on paying off their credit card and other forms of debt.

When asked what scares them most about a potential recession, respondents cited the cost of living increases for expenses like rent, groceries, and gas as their primary concern, with job loss being another major worry for many individuals.

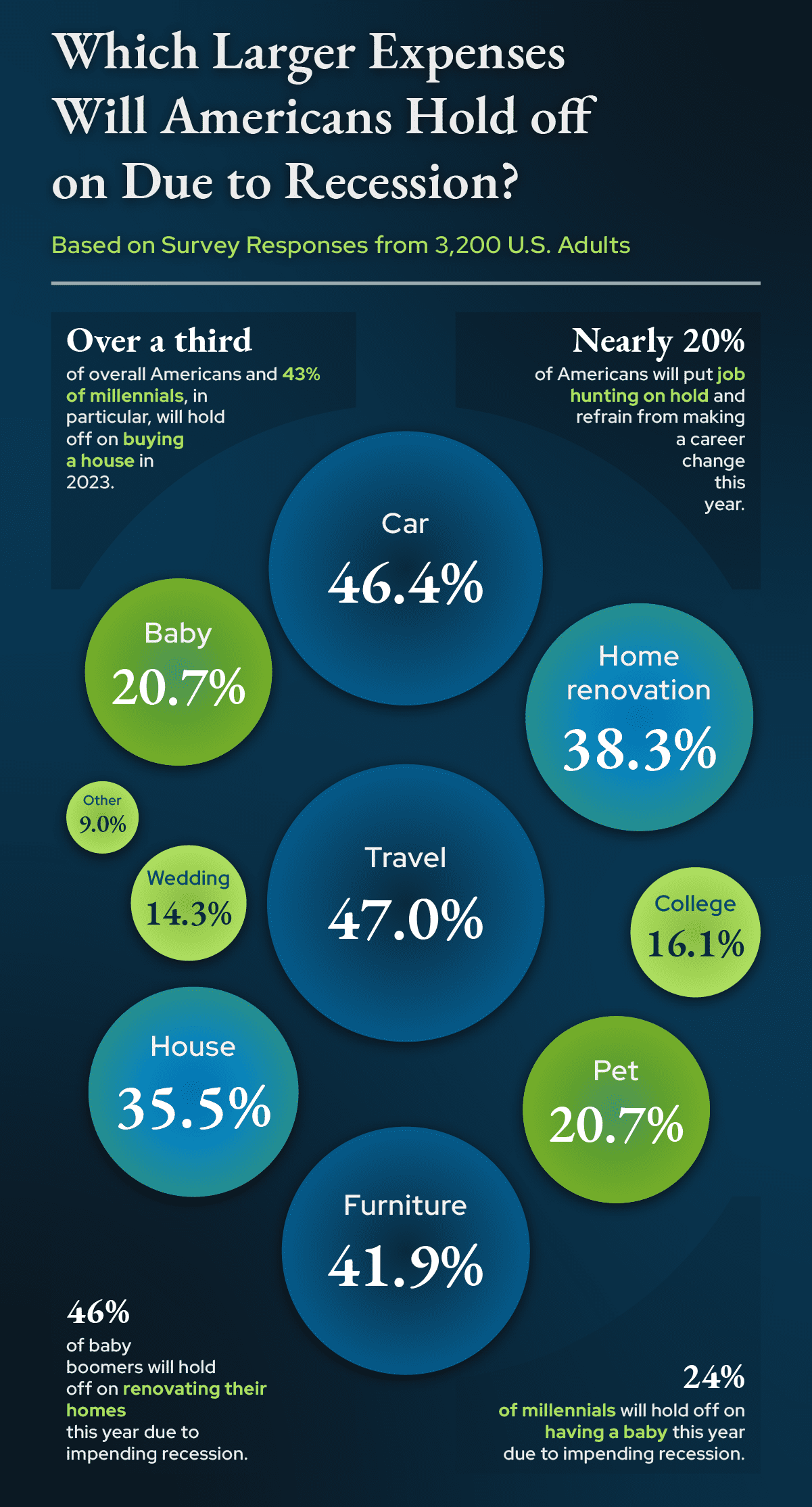

Which Larger Life Expenses Will Americans Cut First?

As the looming threat of a recession continues to stir anxiety among Americans, many are taking significant steps to prepare by delaying major expenses such as housing, travel, starting a family, and making career changes.

Over one-third of Americans are planning to hold off on buying a house in 2023 due to the expected economic downturn. This number increases to 43% when looking solely at millennials.

As for leisure activities, the largest share of Americans (47%) plan to hold off on travel in 2023 in anticipation of a recession. Similarly, 46% of baby boomers are planning to delay home renovations as a potential cost-cutting measure in light of the economy’s unpredictability.

Home renovation projects and vacation plans aren’t the only things coming to a halt in light of the projected recession; many younger Americans are also waiting to start a family in order to prepare for potential financial hardship. Almost a quarter of millennials are planning to hold off on having a baby in 2023 due to concerns about the economic climate. Moreover, nearly 20% of Americans are delaying any job hunting or career changes this year in anticipation of a recession.

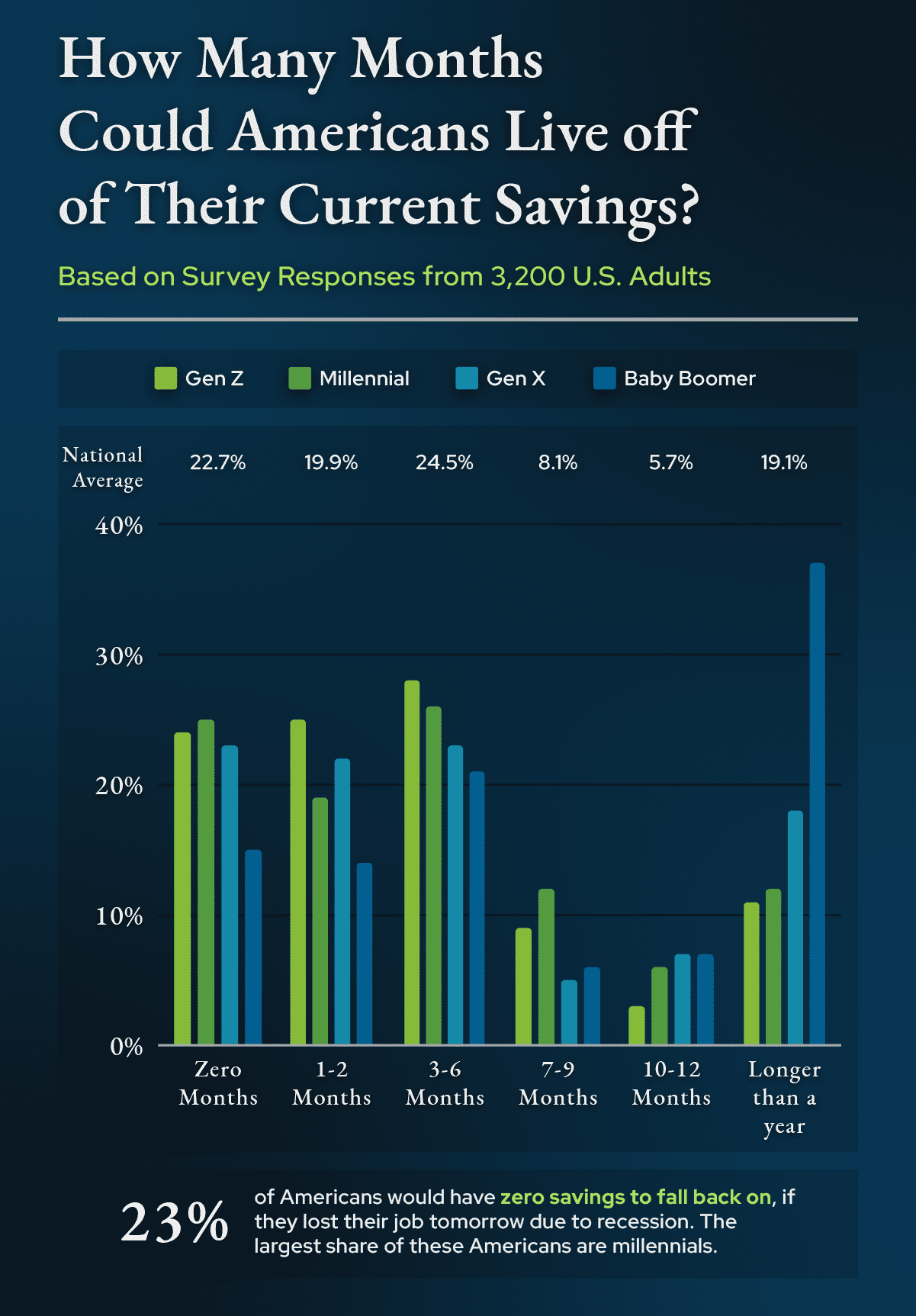

How Many Months Could Americans Live off of Their Current Savings?

While many finance professionals recommend saving 20% of each paycheck for a rainy day, that is unrealistic for many Americans. We found that if they lost their jobs due to an economic recession, nearly a quarter of Americans could last three to six months on their current savings. However, another 23% of Americans would have no savings to fall back on in such a scenario, with millennials being the largest demographic in this category.

Baby boomers appear to be the most financially prepared for a recession, with 37% having enough savings to last over a year if they were to lose their jobs tomorrow. Only 11% of Gen Zers and 12% of millennials can say the same.

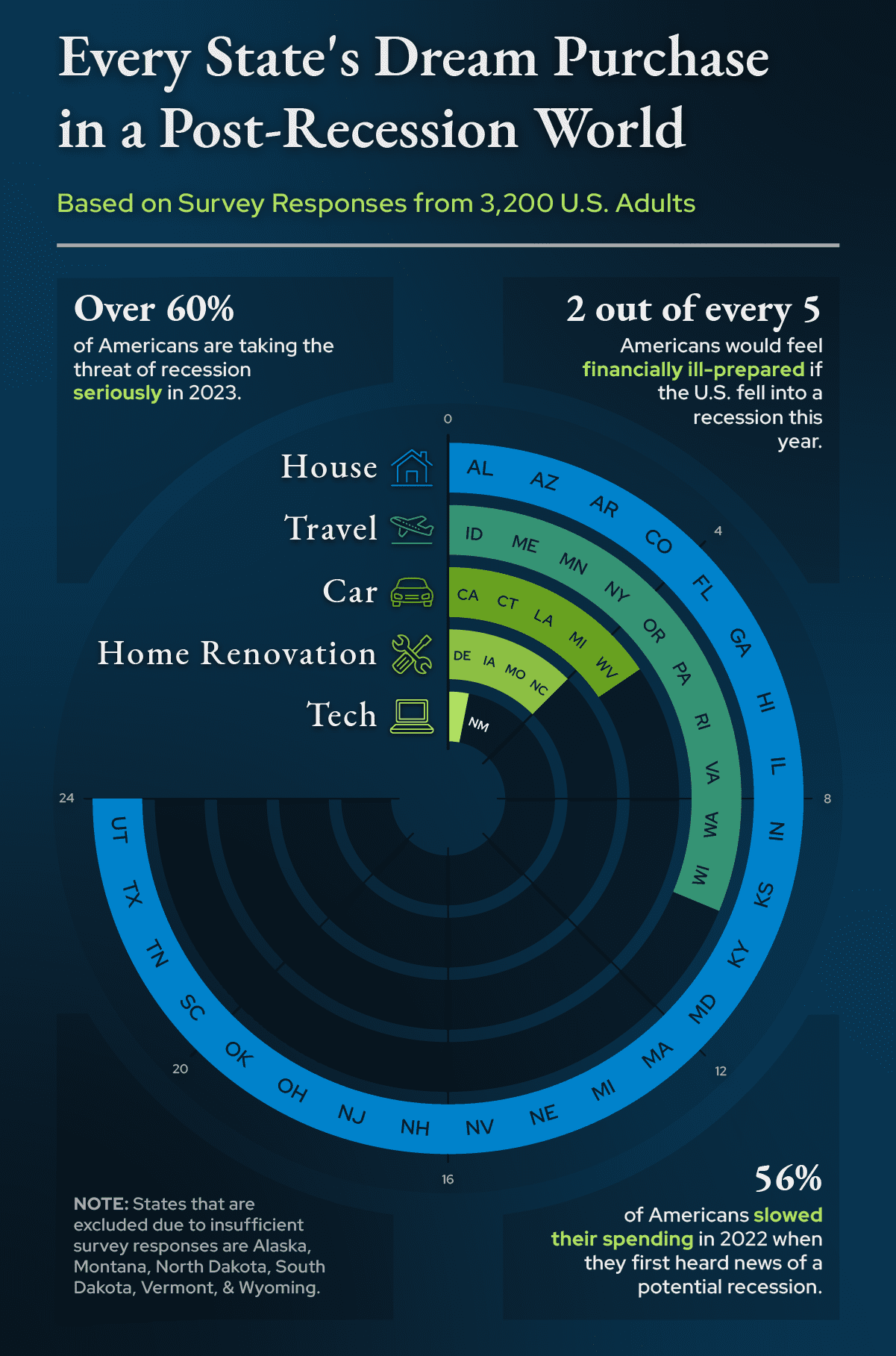

Every State’s Dream Purchase After a Recession

While Americans are cutting back on spending on big-ticket items in the short term, they continue to plan for their long-term financial goals. Our survey found that the majority of people in 24 states plan to buy a house once the recession is over. This is likely because housing is a long-term investment that can appreciate, providing security and stability in the long run.

Travel came in second, as Americans in 10 states say they are eager to take a trip after exercising financial discipline and restraint during a challenging period. Buying a car came in third, followed by home renovations and technology purchases.

Closing Thoughts

We found that the majority of Americans are taking the threat of a recession seriously in 2023.

From cutting back on discretionary spending to building up savings and paying off debt, there are many strategies that people are employing to protect themselves in uncertain times.

Just as recession planning can provide a safety net in the case of unexpected job loss, insurance can cushion against unexpected expenses like high medical costs or costs associated with property damage. As Americans continue to look for ways to cut back on spending in times of economic uncertainty, Assurance IQ offers a way for people to shop around for different insurance policies to help fit their budget. Assurance IQ can help you compare affordable insurance options for health, home, auto, and more to pick the coverage that fits your needs.

Methodology

Assurance IQ surveyed 3,200 U.S. adults across 44 states and a variety of demographics from February 16 to 21, 2023 to find out how Americans are planning for a potential recession this year. The study included a representative sample collected across states, age ranges, and gender. States excluded due to insufficient survey responses were Alaska, Montana, North Dakota, South Dakota, Vermont, and Wyoming.