Movies and books often depict spontaneous acts and grand gestures as romantic. But more than three quarters of couples who are married, engaged, or in a serious relationship might not be charmed by such behavior this Valentine’s Day.

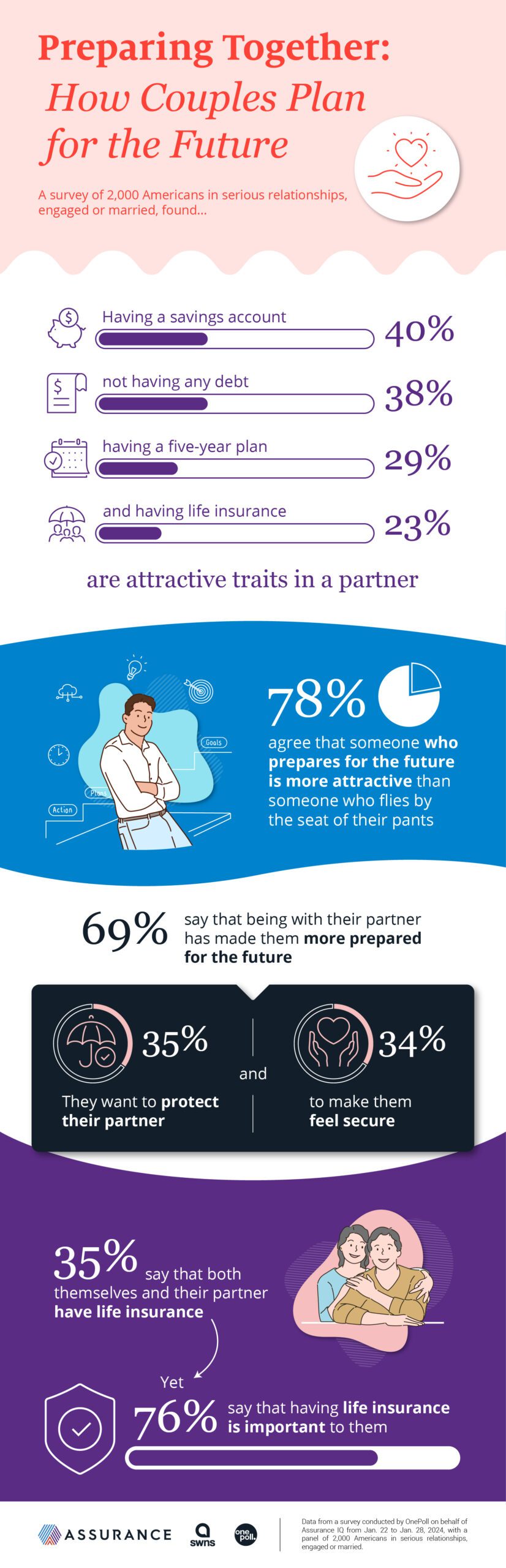

According to a recent survey of 2,000 US adults in relationships, 78% agree that someone who prepares for the future is more attractive than someone who flies by the seat of their pants.

Table of Contents

Thoughtful and Practical Gifts Trump Expensive Gifts

Around half of respondents prefer to receive thoughtful gifts from their partners, while only 10% want something expensive. Flashy, expensive gifts might send the wrong message overall, as your partner is more likely to dream about financial well-being. Many respondents said that having a savings account (40%), not having any debt (37%), having a 5-year plan (29%) and having life insurance (23%) were attractive traits in a partner.

Couples looking for romantic ways to say, “I love you” might consider shoring up their joint financial wellness as an alternative to jewelry, flowers, or candy. At the start of their relationship, only 17% of partners wanted to receive practical gifts. But today, 25% would like to receive practical gifts, like appliances or having their bills paid. When it comes to millennials, nearly one third (32%) prefer practical gifts.

More than two-thirds (67%) of partners agreed that as their relationship goes on, practical gifts become more and more romantic.

Preparing Together

Being in a relationship seems to help people feel more secure and prepared for the future. Most respondents (69%) said that having a partner made them more prepared for the future, with reasons including feeling more secure together (65%), their partner encouraging them to plan ahead (39%), a desire to protect their partner (35%) and a desire to make their partner feel more secure (34%). Men were more likely (81%) to say that having a partner made them more prepared for the future than women.

Only 24% of partners said they felt unprepared for the long-term future in terms of retirement, end-of-life decisions, savings, etc. However, people did not start thinking about planning for their long-term future until they were 32 and did not start to feel prepared for the future until they were 34, on average.

When it comes to preparing for their relationship’s future, however, people seem to waste no time. Being together for one to two years seems to be the sweet spot for bringing up marriage (33%), having children (33%), adopting a pet (26%) and buying a house (25%). However, a significant number of couples broached these topics within six months, with 23% discussing marriage and 24% discussing children by that time.

While couples seemed eager to discuss happy milestones early on, planning for life’s unexpected plot twists came later. Most couples waited at least three years before discussing topics like end of life wishes (62%), wills (65%), life insurance (53%) and funeral plans (64%). And less than half of respondents had discussed these topics at all—only 39% of couples had broached the topic of life insurance, 33% had discussed wills, and 32% had talked about end of life wishes. Baby Boomers were the most likely generation to have discussed life insurance (57%), while the Silent Generation (people born between 1928 and 1945) was most likely to have discussed wills (73%) and end of life wishes (61%) with their partners.

Getting Life Insurance Can Show Someone You Care

Getting life insurance can be an important gesture to show your partner that you love them, and that you want to make sure they are supported even if you aren’t around one day. Life insurance can bolster your financial security as a couple by providing you with money to cover day-to-day expenses, mortgage payments, childcare, and funeral, burial and cremation costs if one partner dies.

Thinking about your partner dying might not sound very romantic. But taking steps to shore up their financial security and show them you have their back can be the ultimate gesture of love. According to the survey, having life insurance is important to 76% of partners. Yet only 35% of respondents say both they and their partner have life insurance. And for nearly one third (31%) of respondents, neither partner has life insurance.

Getting life insurance when you are young and healthy can help you lock in a better rate. Even if you and your partner do not have shared financial obligations today, like a mortgage or children, getting life insurance soon could be a smart financial move if you plan to do these things one day. Around 30% of respondents said that their partner having life insurance would help them feel more prepared for the future.

You might put off life insurance because you think you cannot afford it. But life insurance is probably a lot more affordable than you think. According to a Forbes Advisory survey, 82% of Americans overestimate the cost of life insurance. Most believe the monthly cost of a term life insurance policy is at least three times higher than it is. You can get an estimate of how much term life insurance would cost you through our free life insurance calculator.

Methodology

This random double-opt-in survey of 2,000 Americans in serious relationships, engaged or married was commissioned by Assurance IQ between Jan. 22 and Jan. 28, 2024. It was conducted by market research company OnePoll.