The high cost of healthcare and complexity of the health insurance system create significant barriers to care for American families. That could explain why almost two-thirds (65%) of the insured Americans we recently surveyed did not visit their primary care doctor in the past year.

If you’re struggling to understand and pay for the costs associated with medical treatment, you’re not alone. Insurance can be overwhelmingly complicated and confusing — especially for people who do not receive it through an employer.

On behalf of Assurance IQ, OnePoll conducted a survey of 2,000 American adults with health insurance to better understand how elements like cost, access, and complexity factor into their decisions to seek care. We also broke down ways people can overcome some of these barriers to improve both their health and financial well-being.

Top Reason for Skipping Care: People Do Not Like Going to the Doctor

Our research revealed that many people do not like going to the doctor because they cannot fit it into their schedule, or because they feel uncomfortable.

- People are too busy, or do not have time: Nearly 28% said they would delay care if they are busy, and wait until a problem becomes more urgent. For 10% of respondents, anticipated long wait times at the doctor’s office, urgent care clinic, or emergency room would prevent them from seeking care. Additionally, 6% of respondents said they might forego care because they are caregivers themselves, and might not be able to find backup support.

- Some people just do not like doctors: Nearly a quarter (24%) of respondents said they generally don’t like going to the doctor. And 17% said they would avoid care because they do not have a doctor they trust.

It’s easy to put off medical appointments for another day, but preventative care can make a big difference in your health. Our survey respondents agreed, with around 41% saying encouraging more people to use preventative care is one of the best ways to improve the American healthcare system.

When you catch a health concern early, you usually have more options for treating it. Delaying care can ultimately cost you more time and money than staying on top of preventative care.

Make sure you schedule an annual physical with your primary care doctor. These appointments are completely covered by most health insurance plans, so you likely will not have to pay anything out of pocket. If you do not have a primary care doctor that you like, check with your insurer to find a new one.

Top Reason for Skipping Care: It’s Too Expensive

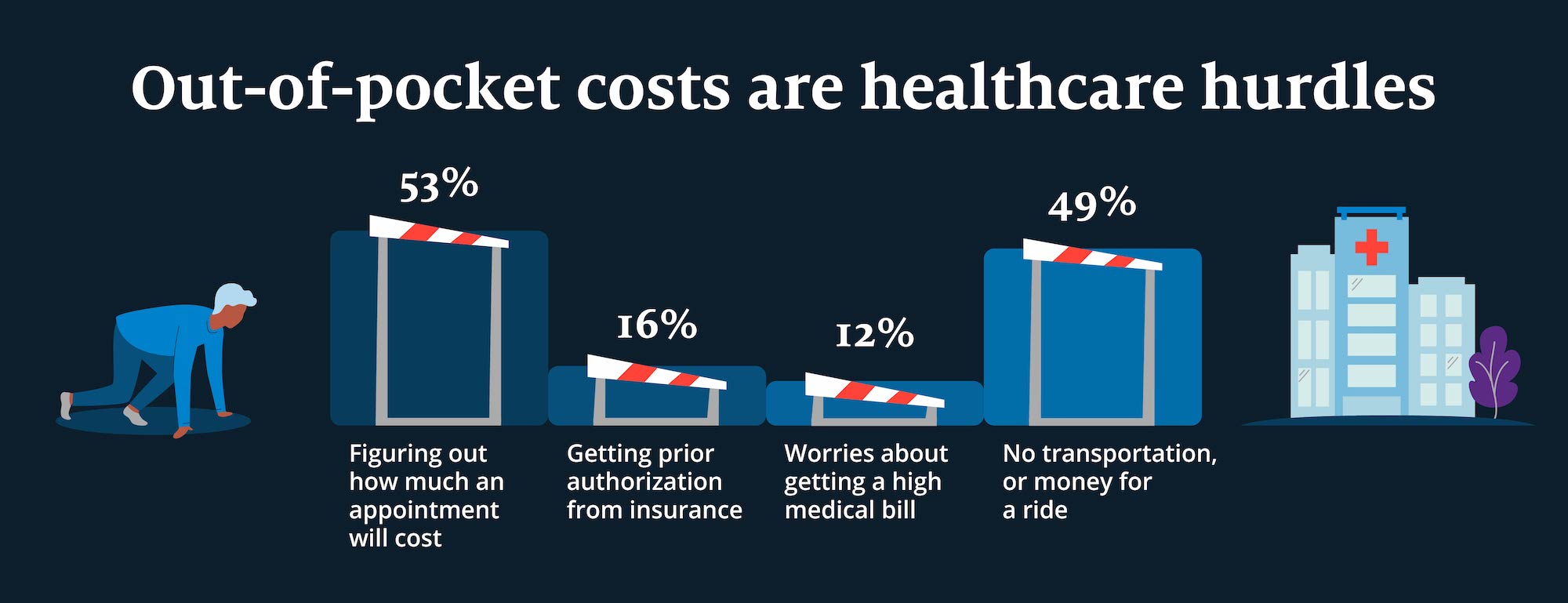

While preventative care is typically 100% covered by most health insurance plans, figuring out the cost of specialist appointments, treatments, tests, and other procedures can be overwhelming. Our survey found that 53% of respondents would skip care if they were not able to figure out how much a visit would cost them out of pocket.

Around 16% prefer not to interact with their health insurance company to get prior authorization, yet nearly 12% said they worry about getting a high medical bill as a result of treatment. This concern is not without merit — around 13% of respondents said that they have received a medical bill that they did not understand or expect in the past year, and 14% have had to dispute a medical bill or unpaid health insurance claim.

Choosing the right health insurance plan can help you minimize your out-of-pocket (OOP) costs. But over half of respondents (51%) told us they don’t plan for these costs at all. Speaking to a licensed insurance agent can help clarify what OOP costs you can expect before you enroll in a plan.

Agents can ask you questions and provide insurance coverage recommendations that address your specific needs. For example, an Assurance IQ agent can make sure a plan covers your primary care doctor, specialists you need to see, and your regular prescriptions. They can also help you understand if you’re eligible for certain subsidies or cost-of-living benefits that can lower your overall cost of healthcare.

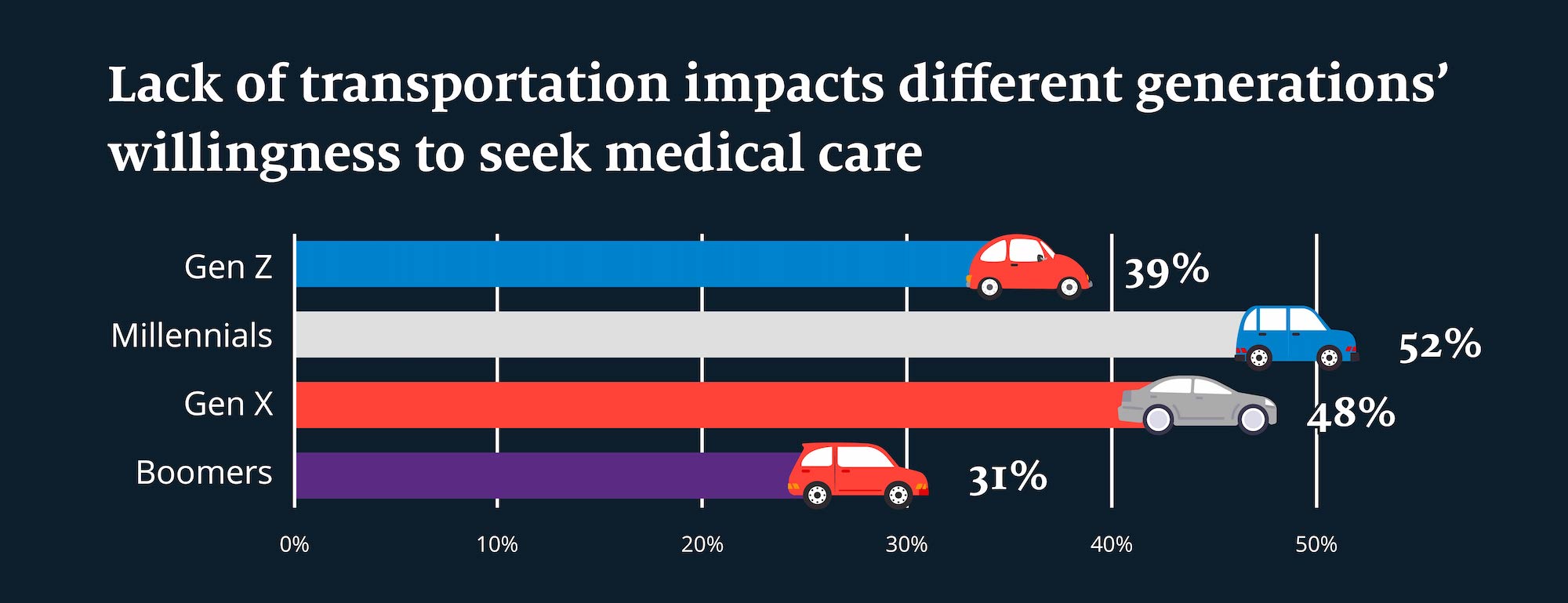

Top Reason for Skipping Care: Transportation

Nearly half (49%) of respondents indicated that they would skip medical care if they did not have transportation to the appointment. This was especially true for Northeastern and Southeastern states. This could be because these regions have some of the largest rural populations. For example, according to the Census, 65% of people in Vermont reside in rural areas.

The Northeast is also home to several high cost of living cities where people’s paychecks are already stretched thin. Additionally, in parts of the Southeast, public transportation can be extremely limited.

If you’re worried about the cost of transportation to the doctor, you have options:

- Medicare: If you have Medicare, it may cover transportation to doctor’s appointments if you meet the eligibility criteria.

- Medicaid: If you are eligible for Medicaid, Medicaid may also provide transportation to and from care appointments if you don’t have a working vehicle, or if you have certain disabilities or health conditions.

- HSA or FSA: If you have private insurance and have a Health Savings Account (HSA) or Flexible Savings Account (FSA), you may be able to pay for medical transportation with pre-tax funds.

- Telemedicine: Depending on the reason for seeking care, consider a telemedicine appointment over the phone or video chat, eliminating the need for transportation. In another study, we found that 62% of Americans said telemedicine makes them more likely to seek care they would otherwise delay.

Contact your insurance to understand what transportation and telemedicine benefits are available under your plan.

Compounding the Issue: Complexity of Health Insurance

Most people think they understand how the healthcare system works: 68% of respondents said they feel informed about the American healthcare system and more than two-thirds (67%) said they are knowledgeable about their own health insurance coverage. But when asked about specific insurance concepts, there were clear gaps.

A significant portion of Americans with health insurance said they could not explain concepts and terms like:

- The difference between a Health Maintenance Organization (HMO) and a Preferred Provider Organization (PPO) – 34.5%

- A deductible – 29%

- A copayment or co-pay – 29.5%

- A premium – 26%

- The difference between an FSA and an HSA – 31%

- Out-of-pocket (OOP) limit or maximum OOP – 25%

Navigating the complex health insurance landscape without understanding the terminology can be like listening to your GPS talk in a foreign language. Finding and choosing coverage that meets your individual needs can feel overwhelming. At Assurance IQ, our agents can help guide you to a choice that meets your needs.

Where Do We Go From Here?

Our research makes it clear that big changes are needed to improve Americans’ access to quality insurance coverage and healthcare. We asked respondents for their suggestions on how the American healthcare system could be improved.

The top three responses were:

- Encourage more people to use preventative care – 41%

- Increase access to quality insurance coverage – 33%

- Eliminate the fee-for-service payment system – 28%

At Assurance, our mission is to help people improve and protect their financial and personal well-being. We do this by conducting a needs analysis that helps us point you toward plans that cover what matters most. Our unique business model and proprietary technology enables us to do this at scale, providing personalized guidance to every customer.

Finding an insurance plan that meets you and your family where you are in life could improve access to preventative care, while providing better protection from unexpected OOP costs and medical bills when you seek treatment.

Methodology

We surveyed 2,000 U.S. adults with health insurance. Respondents answered questions around what type of health insurance they have, how they budget for healthcare expenses, their perceptions of healthcare in the U.S., and their understanding of health insurance terminology, among other topics.