With rent and home prices still soaring to all-time highs, renters may wonder what portion of their monthly rent actually contributes to their landlord’s mortgage.

To determine the extent to which renters might be covering their landlord’s mortgage expenses across the United States, we collected rental data from the August 2023 Zillow Observed Rent Index. We then compared this rental data to the average mortgage payment, which was calculated based on a 30-year fixed mortgage, the average mortgage rates in each state, and an average down payment equal to 13% of the median house price, according to the Zillow Home Value Index.

Whether you’re a landlord or a tenant, we believe this data sheds light on the broader significance of safeguarding your residence and possessions. Assurance IQ’ can help connect you with a home insurance or renter’s insurance policy that will help protect your property and provide liability coverage.

Continue reading to uncover the realities of rent costs and how they may influence your financial future.

Table of Contents

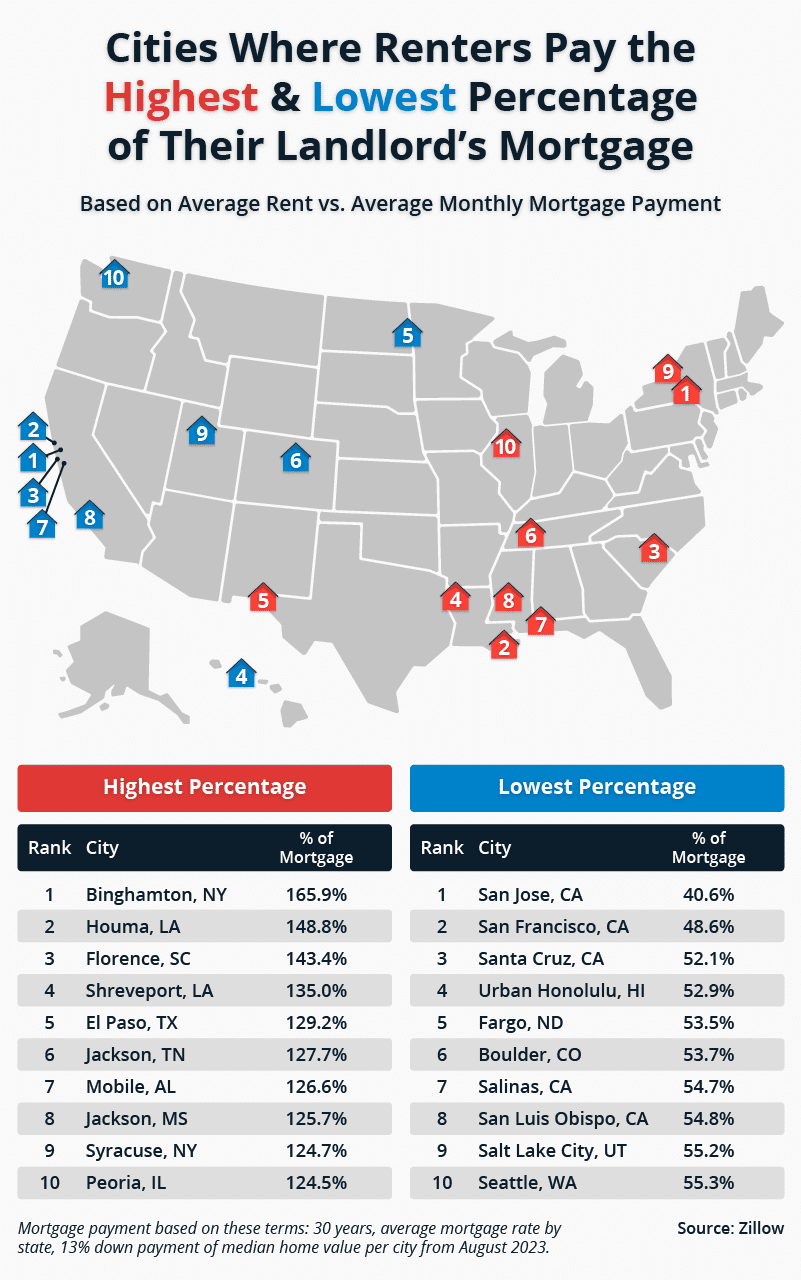

Cities Where Renters Could Be Paying the Highest and Lowest Percentage of Their Landlord’s Mortgage

With factors like surging home prices, rampant inflation, and heightened demand for rental properties, it comes as no surprise that renters are becoming increasingly frustrated. Many are left feeling that their rent is too high or that their landlord isn’t justified in raising it.

To better understand the connection between monthly rent costs and mortgage payments, we analyzed average monthly mortgage payments alongside monthly rental rates in 250 of the largest U.S. metropolitan areas.

The cities where renters could be paying the highest percentage of their landlord’s mortgage include:

- Binghamton, NY

- Rent: $1,551.76

- Mortgage: $935.48

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 165.9%

- Houma, LA

- Rent: $1,465.80

- Mortgage: $984.88

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 148.8%

- Florence, SC

- Rent: $1,414.39

- Mortgage: $986.56

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 143.4%

- Shreveport, LA

- Rent: $1,227.52

- Mortgage: $909.16

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 135%

- El Paso, TX

- Rent: $1,586.77

- Mortgage: $1,227.82

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 129.2%

In Binghamton, NY, renters could potentially be covering 165.9% of their landlord’s mortgage with their monthly rent. The average monthly rent in Binghamton stands at $1,551.76, while the typical mortgage payment is $935.48. Notably, places like Binghamton have witnessed significant rent hikes, with a rise of over 20% from January 2022 to January 2023.

Two cities in Louisiana are among the top five where renters could be paying a significant portion of their landlord’s rent. Houma, LA, takes the second spot, with rent covering roughly 148.8% of their landlord’s mortgage, while Shreveport, LA, holds the fourth position, with rent potentially offsetting 135% of their landlord’s mortgage. In areas like Houma, the impact of Hurricane Ida has rendered numerous buildings uninhabitable — exacerbating the rent costs.

We also wanted to find the cities where renters could be paying the lowest percentage of their landlord’s mortgage. These cities include:

- San Jose, CA

- Rent: $3,385.56

- Mortgage: $8,343.96

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 40.6%

- San Francisco, CA

- Rent: $3,173.42

- Mortgage: $6,526.42

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 48.6%

- Santa Cruz, CA

- Rent: $3,456.30

- Mortgage: $6,631.13

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 52.1%

- Honolulu, HI

- Rent: $2,679.28

- Mortgage: $5,063.87

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 52.9%

- Fargo, ND

- Rent: $924.08

- Mortgage: $1,726.50

- Percentage of Landlord’s Mortgage Renters Could Be Paying: 53.5%

Three California cities secured the top three spots where renters contribute the lowest percentage to their landlord’s mortgage. These cities are San Jose (40.6%), San Francisco (48.6%), and Santa Cruz (52.1%). Surprisingly, even though rents in these cities are steep, they still fall short of covering their landlord’s entire mortgage and then some. This is likely due to high home values in these areas.

In Honolulu, HI, the average rent stands at $2,679.28, while the average mortgage payment amounts to $5,063.87. Renters can potentially cover 52.9% of their landlord’s mortgage, which is still considerably lower than the national average of 101.75%.

Comparing Rent and Mortgage Payments in U.S. Cities

With rent up 17% in Chicago, 19% in New York, and 10% up in D.C., you may be wondering whether your landlord is raking it in, leaving this question at the top of your mind — how much do landlords make?

Even when rental prices are high, it may be covering a fraction of your landlord’s mortgage or not significantly impacting it at all. To find out what percentage of your rent could cover your landlord’s monthly mortgage payment, we ranked 250 of the largest metropolitan areas and used Zillow’s data on rent and home values.

From York, PA, to Yakima, WA, you can delve into the cities where renters are only partially contributing to their landlord’s mortgage and those where they fully cover it.

Closing Thoughts

Whether you’re a landlord or a renter, grasping the intricate financial dynamics of rising rent costs is crucial in today’s housing market. It’s more than just pinpointing the right location or the perfect number of bedrooms. For some, transparency is key, including understanding how your rental payments influence your landlord’s mortgage.

In this comprehensive picture, safeguarding your possessions through home or renter’s insurance is essential. Shop and compare home insurance quotes to discover the coverage that aligns with your individual needs.

Methodology

To determine how much of their landlord’s mortgage renters could be paying across the U.S., we analyzed the most recent Zillow estimates on rent and home values for the 250 largest U.S. metros where data was available.

The average rent by city is pulled directly from Zillow’s Observed Rent Index and the average mortgage payment is based on a 30-year fixed mortgage, the average mortgage rate in each state, and an average down payment of 13% of the median house price from the Zillow Home Value Index.

Throughout the study, a value of 100% would indicate that a renter could be paying all of their landlord’s mortgage, a value under 100% would mean they’re paying less, and a value over 100% would mean they’re paying more.