First-time home buyers often save diligently for a substantial down payment, yet the closing costs at signing can still surprise them. While a few sellers might cover these fees, the majority of buyers find themselves bearing this cost.

To shed light on how much closing costs vary state by state, we analyzed typical closing cost expenses like appraisal costs, attorney fees, home inspection costs, and more. Keep reading to discover the average closing cost in your state.

Table of Contents

Key Insights

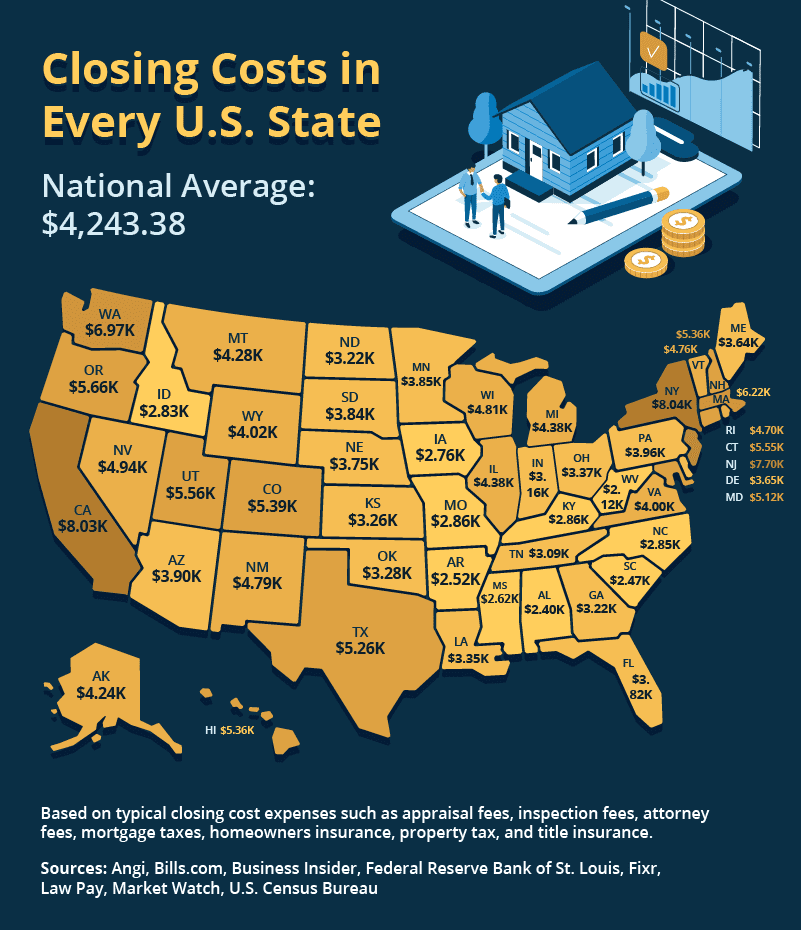

- The average closing cost in the U.S. is $4,243.

- Closing costs are, on average, 1.87% of the median home value across the U.S.

- New York, California, and New Jersey are the states with the highest average closing costs — all over $7,500.

- West Virginia, Alabama, South Carolina, and Arkansas have the lowest average closing costs — all under $2,500.

Closing Costs in Every U.S. State

To calculate closing costs for each state, we considered common expenses like appraisal fees, inspection fees, attorney fees, mortgage taxes, homeowners insurance, property tax, and title insurance. We standardized our calculations using a 30-year fixed mortgage rate of 6.90% across all states to increase accuracy.

The states with the highest average closing costs across the U.S. are:

- New York – $8,039

- California – $8,028

- New Jersey – $7,702

- Washington – $6,966

- Massachusetts – $6,223

The states with the lowest average closing costs across the U.S. are:

- West Virginia – $2,124

- Alabama – $2,400

- South Carolina – $2,473

- Arkansas – $2,518

- Mississippi – $2,622

New York topped the U.S. with an average closing cost of $8,039, which equates to 2.47% of the state’s median home value ($325,000). This is influenced by high homeowners insurance premiums, averaging $3,245, and a median property tax payment of $5,590.

In California, closing costs average $8,023, making it the state with the second-highest average. These costs represent 1.49% of the median home value ($538,500). Home buyers in California typically face a title insurance fee averaging $4,550 and a median property tax payment of $3,996.

We also examined states with the least closing cost burdens. West Virginia stands out with the lowest closing costs, averaging $2,124. This represents 1.72% of the state’s median home value ($123,200). Residents in West Virginia typically encounter attorney fees averaging $168 and a median property tax payment of just $719.

In Alabama, closing costs are a bit higher, averaging $2,400. This amounts to just 1.60% of the state’s median home value ($149,600). Home buyers in Alabama can expect inspection fees of $387.50, a median property tax payment of $608, and a mere $84 in mortgage interest due at closing.

Taking a broader look at regional trends, we discovered that the five states with the lowest average closing costs are all in the South, averaging $3,266. This represents 1.83% of their median home values ($182,460). Following the South is the Midwest ($3,710), the West ($5,242), and the Northeast ($5,358).

Comparing Closing Costs and Home Value in Every U.S. State

Wondering about the average closing cost in your state? Browse the table below for a comprehensive look at closing costs across the U.S., alongside median home values. We’ve also detailed closing costs as a percentage of the median home value, with the national average hovering around 1.87%.

Closing Thoughts

Buying a home comes with its share of expenses, and closing costs are a significant part of that. While some of these costs might be negotiable, being aware of the average closing costs in your state can equip you for what lies ahead.

Methodology

To calculate the estimated closing costs in every state, we researched local cost data typically associated with closing fees such as inspections, appraisals, and homeowners insurance.

Figures for most estimations were pulled as a state-wide average from varying sources. We based mortgage taxes on the average mortgage rates and payments for each state. Homeowners insurance costs were calculated as 10% of the total annual premium, and property tax estimates covered half a year’s total tax amount.

An itemized list of the fees included in our estimation is below:

Fee | Source |

|---|---|

Home Appraisal Fees | |

Attorney Fees | |

Home Inspection Fees | |

Land Survey | |

Homeowners Insurance Premiums | |

Median Property Tax Payment | |

Mortgage Rates | |

Median Monthly Mortgage Payment | |

Title Search and Insurance | Bills.com |