Buying a home is often the most significant investment you’ll make in your lifetime, and the experience can be both exhilarating and nerve-wracking. To demystify the homebuying process and offer valuable insights, we surveyed over 400 licensed real estate agents and brokers across the U.S. We delved into key questions, such as the average number of homes clients tour before making an offer, to provide you with a behind-the-scenes look at what really goes on.

Still, no matter how smooth or bumpy your homebuying journey may be, protecting your investment with comprehensive home insurance is crucial. Assurance IQ offers a way to shop and compare home insurance rates, ensuring you get the best coverage for your new abode. Read on for an inside take on the homebuying process from the perspective of realtors.

Table of Contents

Key Insights

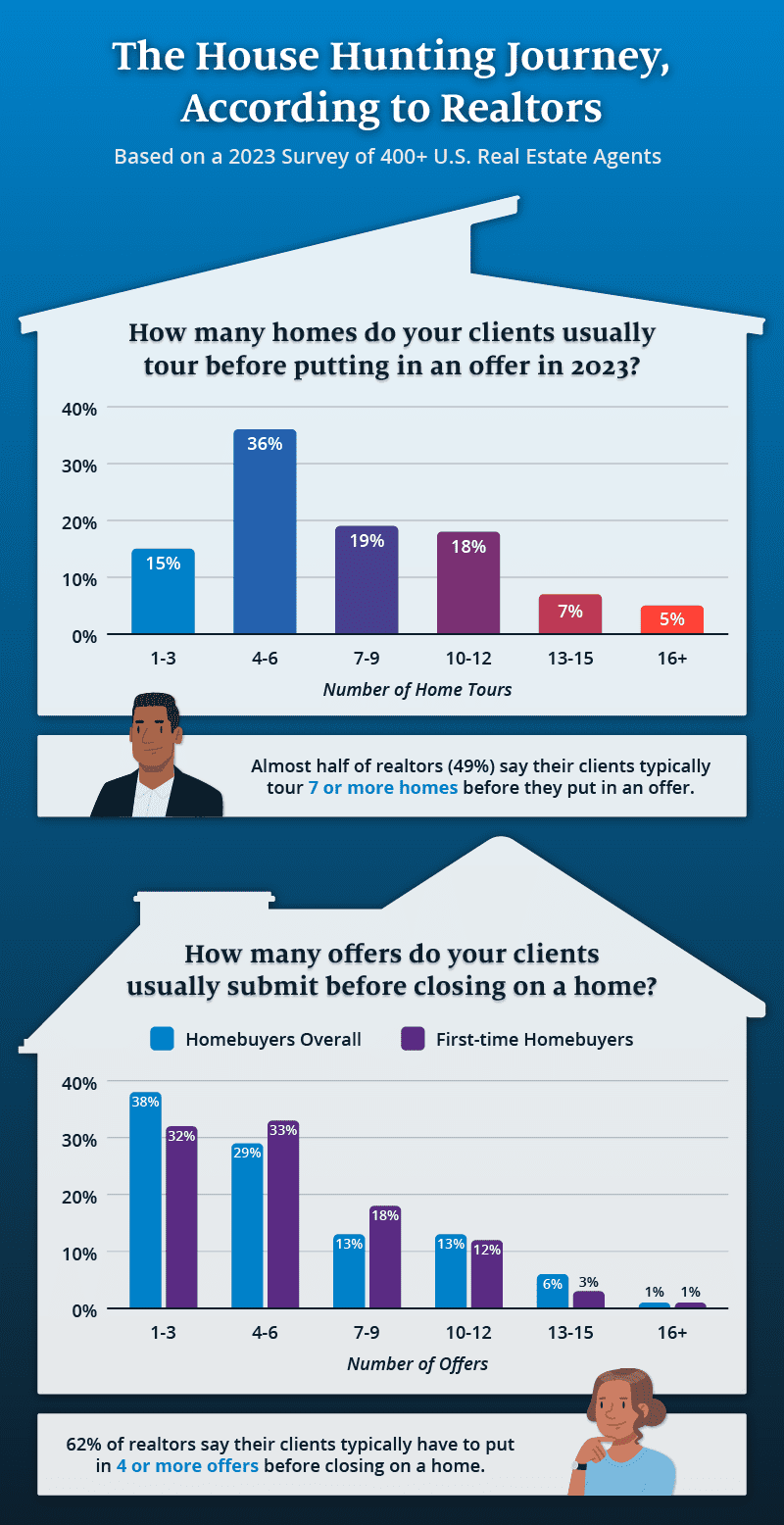

- Nearly half of realtors (49%) say their clients typically tour seven or more homes before they put in an offer.

- 68% of realtors say their first-time homebuyer clients typically have to put in four or more offers before closing on a home.

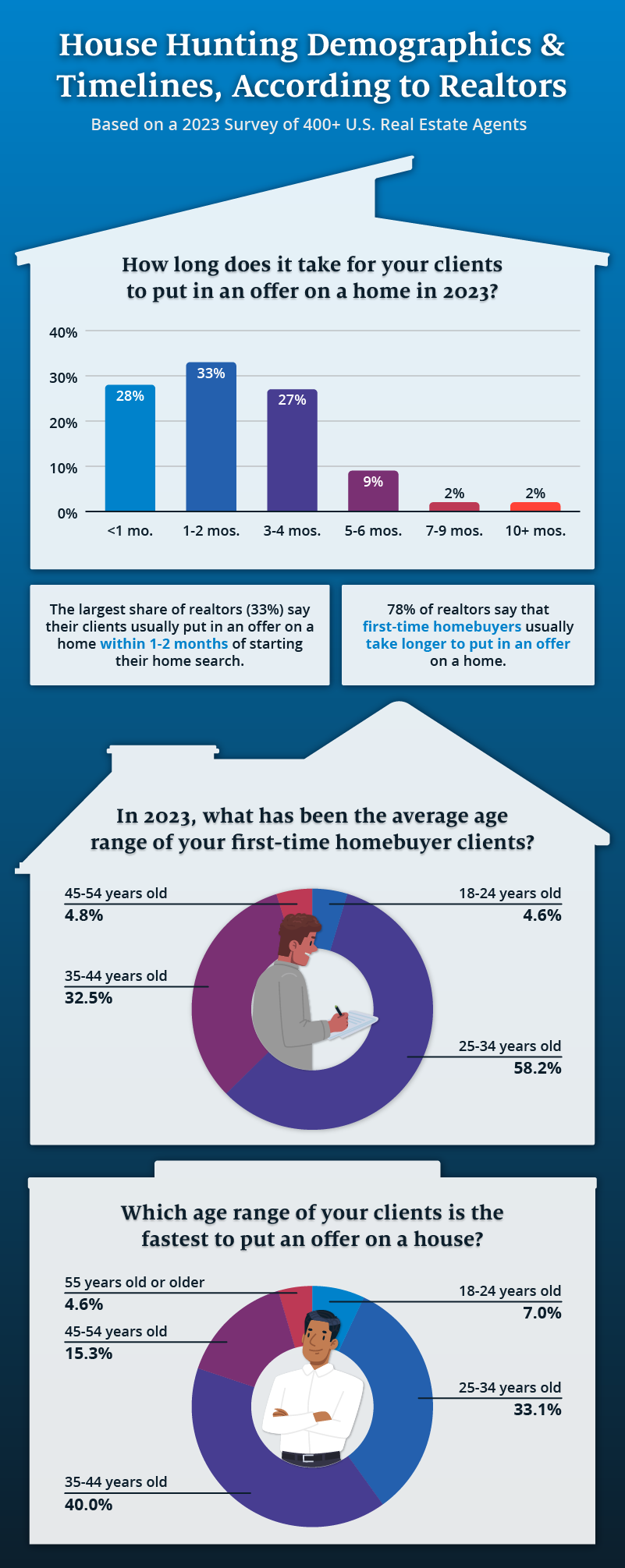

- The largest share of realtors (33%) say their clients usually put in an offer on a home within one to two months of starting their home search.

- According to the realtors, the most common age range of first-time homebuyers is 25-34 years old (58%). But almost a third of realtors (32%) say the average age range of their first-time homebuyers is 35-44 years old in 2023.

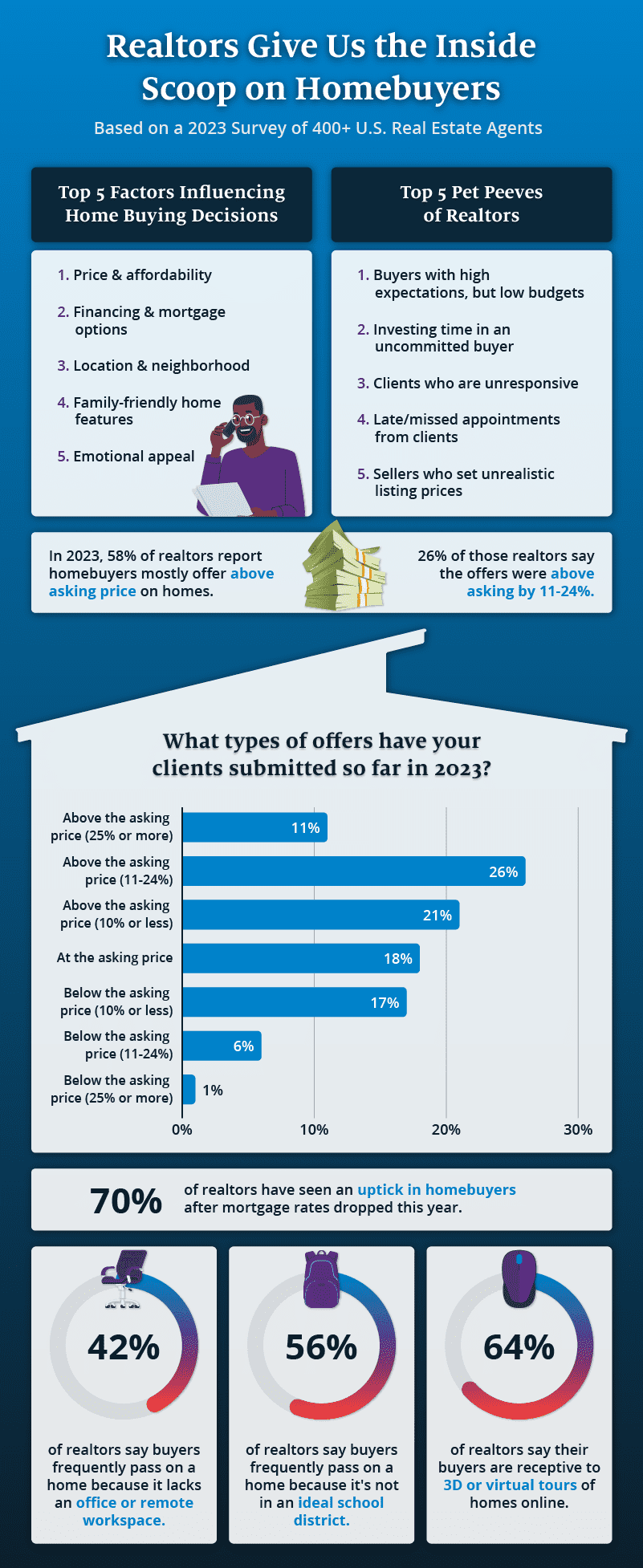

- 58% of realtors say the majority of their clients have put in offers above the asking price so far in 2023. And the majority of those realtors say the offers were above asking by 11-24%.

- 56% of realtors say buyers frequently pass on a home because it’s not in an ideal school district.

- 42% of realtors say buyers frequently pass on a home because it doesn’t have an office or remote workspace.

- 70% of realtors say they’ve seen an uptick of homebuyers in 2023 since mortgage rates have dropped.

From Tours to Offers: The Numbers Behind Closing On a Home

When it comes to touring homes before making an offer, the landscape is quite varied. The largest share of realtors (36%) say their clients typically tour between four to six homes before putting in an offer in 2023. However, nearly half of the realtors surveyed (49%) indicate that their clients usually tour seven or more homes before putting in an offer.

When it comes to the number of offers made before closing, the largest share of realtors (38%) of realtors report that their clients generally submit one to three offers before successfully closing on a home. On the other hand, a significant 62% of realtors say their clients usually have to put in four or more offers before they can close the deal.

The situation is slightly different for first-time homebuyers. According to 33% of realtors, these clients typically submit four to six offers before closing. Even more striking, 68% of realtors report that first-time homebuyers usually have to put in four or more offers to secure a home.

Lastly, when it comes to taking advice about offers, 65% of realtors say that clients take their advice “often,” while 21% state that clients heed their advice “sometimes,” showcasing an interesting side of the client relationship.

Age Meets Urgency: The Clock and Calendar of Homebuying

When it comes to the timeline of putting in an offer, realtors offer some intriguing insights. The largest share (33%) say that their clients usually make an offer within one to two months of initiating their home search. Remarkably, 87% of realtors report that the majority of their clients are quick to act, putting in an offer within four months or less after starting their search.

First-time homebuyers appear to tread more cautiously. According to 78% of realtors, these newcomers to the housing market usually take longer to put in an offer compared to those who have been through the process before.

The average age to buy a house for the first time is particularly noteworthy. The majority of realtors (58%) report that their first-time homebuyers typically fall within the 25-34 age range. However, a significant 33% of realtors have observed that their first-time homebuyers in 2023 are between 35 and 44 years old. This shift towards later homeownership is likely influenced by rising housing costs and the fact that millennials are not buying homes at the same rate as previous generations.

When it comes to speed in making offers, the 35-44 age group stands out. The largest share of realtors (40%) say that clients in this age bracket are the fastest to put in an offer on a home.

Deal or No Deal: Realtors Offer an Inside Scoop on Homebuying

When it comes to the factors that most influence homebuying decisions, price and affordability reign supreme. They are closely followed by financing and mortgage options, as well as location and neighborhood considerations. These elements often serve as the make-or-break criteria for potential buyers.

On the flip side, realtors have their own set of challenges and pet peeves when it comes to the client relationship. Topping the list are buyers who have sky-high expectations but low budgets, making it difficult to find a suitable match. Realtors also express frustration with investing time in uncommitted buyers and dealing with unresponsive clients.

As we navigate the competitive landscape of the 2023 real estate market, the types of offers submitted by buyers have become a focal point for both realtors and prospective homeowners. A significant 58% of realtors report that homebuyers are primarily offering above the asking price for homes so far in 2023. In contrast, 24% say that buyers are putting in offers below the asking price, and 18% report offers coming in at the asking price. Among those buyers who are offering above the asking price, the majority are exceeding it by a range of 11-24%.

Adding another layer to this complex market are several emerging trends and observations. For instance, 70% of realtors have noticed an increase in homebuyers following a drop in mortgage rates this year. When it comes to deal-breakers, 42% of realtors say that a lack of an office or remote workspace often leads buyers to pass on a home, while 56% point to an undesirable school district as a frequent deterrent.

On the technological front, 64% of realtors report that buyers are open to 3D or virtual tours of homes online. However, it’s not all smooth sailing; 46% of realtors admit they have sold a home that they believe their client may eventually regret purchasing, which may impact their client relationship in the future.

Closing Thoughts

Buying a home involves navigating a maze of choices, from the number of homes toured to the types of offers submitted. While realtors can guide you through the complexities of the market, they also stress the importance of securing your investment with comprehensive home insurance.

You may not be able to control every variable in the homebuying process, but you can control how well your new home is protected. Assurance IQ can help you select the best home insurance rates, ensuring that your hard-earned investment is safeguarded.

Methodology

We surveyed 417 licensed real estate agents and brokers across the United States from August 9 to August 16, 2023. Utilizing an online survey platform that employs organic sampling techniques, we were able to gather a geographically representative sample. This ensures that the data reflects a broad spectrum of real estate markets across the country.