Medicare Advantage Preferred Provider Organization (PPO) Plans are a type of Medicare plan sold by Medicare-approved private companies. They offer a different way for people with Medicare to get their health benefits.

Like other types of Medicare Advantage Plans, PPO Medicare Plans cover the same medically necessary services as Original Medicare. They often include benefits not covered by Original Medicare, such as prescription drugs.

The factors that set Medicare Advantage PPOs apart from other available plans pertain to which providers you can see and how much those services cost. Medicare Advantage PPO Plans deliver Medicare-covered services through a network of doctors and hospitals that contract with the plan. Members can get care outside the plan’s network, but seeing the plan’s preferred providers typically costs less.

Table of Contents

- Understanding Preferred Provider Organizations (PPOs) for Medicare Advantage

- Medicare Advantage PPO Plans vs. Other Types

- Benefits and Drawbacks of PPO Medicare Plans

- Your Care Network With Medicare Advantage PPO Plans

- The Costs of a Medicare Advantage PPO

- How to Select a Medicare Advantage PPO Plan

- Get the Most Out of Your PPO Medicare Plan

- Putting It All Together

Understanding Preferred Provider Organizations (PPOs) for Medicare Advantage

Preferred Provider Organizations are one of the most widely offered types of Medicare Advantage Plans. They’re designed to give beneficiaries more flexibility in the doctors and other healthcare providers they choose to see.

Eligibility Criteria

The eligibility criteria for PPO Medicare plans are straightforward. Consumers are eligible to join a plan if they:

- Are eligible for Medicare based on age, disability, or end-stage renal disease

- Have enrolled in Part A and Part B

- Are U.S. citizens or lawfully present in the U.S.

- Live in the plan’s service area.

What Do Medicare Advantage PPO Plans Cover?

PPO Medicare Advantage Plans offer comprehensive health coverage. Each plan is required to cover both Part A and Part B services. Many plans include additional benefits not covered by Original Medicare, such as Part D drug coverage.

The services covered by Original Medicare mandated to be also covered by Medicare Advantage include:

- Inpatient Hospital Care: Original Medicare covers inpatient hospital care under Part A. Other Part A-covered services include hospice care, home health care, and short-term nursing home stays.

- Outpatient Medicare Services: Original Medicare covers outpatient medical services under Part B. Some of the many services that fall under Part B include doctor visits, laboratory tests, X-rays, and same-day surgeries.

- Prescription Drugs: Medicare Advantage PPO Plans usually include prescription drugs covered by Part D in Original Medicare. Part D offers coverage for a wide variety of generic and name-brand medications. If you choose a PPO plan that does not offer prescription coverage, you cannot join a separate Medicare drug plan.

Medicare Advantage PPOs often cover additional benefits not included in Original Medicare. Common supplemental benefits include dental, vision, and hearing care.

Medicare Advantage PPO Plans vs. Other Types

Medicare PPO Plans are just one of the many types of Medicare Advantage Plans on the market. Like plans purchased from the ACA marketplace, Medicare recipients can choose from various managed care plans such as HMOs, PFFSs, SNPs, HMOPOSs, and MSAs.

PPO | HMO | PFFS | SNP | HMO-POS | MSA | |

|---|---|---|---|---|---|---|

Average premium | High | Low | High | Low | Low | None |

Average network size | Large | Moderate | Large | Varies by plan | Large | Nationwide |

Designated primary care physician | Not required | Required | Not Required | Varies by plan | Required | Not required |

Referrals to seek specialist care | Not required | Required | Not required | Varies by plan | Varies by plan | Not required |

Out-of-network care coverage | Yes, partially covered | Not covered | Yes | Varies by plan | Yes, for certain services | Yes, if the plan has a network |

Savings component | No | No | No | No | No | Yes |

PPO Medicare Plans vs. HMO

Health Maintenance Organizations (HMO) are a type of managed care plan offered by Medicare Advantage that requires members to get care from providers in the plan’s network. If plan members choose to get care outside the network, they typically pay the entire cost out of pocket unless it’s an emergency.

Unlike PPO Medicare Plans, HMOs require members to choose a primary care doctor who oversees and coordinates their care. If plan members want to see a specialist, they need a referral from their doctor.

PPO Medicare Plans vs. PFFS

Private-Fee-for-Service Plans (PFFS) are a less common type of plan that pays providers a preset fee for each healthcare service. Some have a network of providers, while others do not. In either case, members can get care from any Medicare-accepting provider who agrees to the plan’s payment terms.

PFFS Plans provide less certainty than PPOs because there’s no guarantee that non-network doctors will accept the PFFS plan’s terms. Providers choose at each visit whether or not to accept the plan. This means consumers are responsible for verifying that non-network providers accept their coverage before every visit.

PPO Medicare Plans vs. SNP

Special Needs Plans (SNPs) are a type of Medicare Advantage Plan offering extra support to people with complex healthcare needs. They customize their covered services and provider networks to better serve their members. There are three types:

- Dual-Eligible SNP (D-SNP): For people eligible for Medicare and Medicaid.

- Chronic Condition SNP (C-SNP): For people with a severe health condition, such as cancer, heart failure, or stroke.

- Institutional SNP (I-SNP): For people who live in a nursing home, rehabilitation hospital, or similar facility.

Some SNPs are structured as PPOs and work the same way as PPO Medicare Plans. Others are HMOs and limit members to in-network providers.

PPO Medicare Plans vs. HMOPOS

Health Maintenance Organizations with a point-of-service option (HMOPOS) are a type of plan that combines features of both HMOs and PPOs. Like regular HMOs, they generally require members to get care from in-network providers. However, they also allow members to get some services outside the network.

HMOPOS plans offer more flexibility than other HMOs but not as much as PPO Medicare Plans. Members still need to choose a primary care physician but may not need a referral to see a specialist. Typically, the point-of-service option is only available for designated services, not all services covered by the plan.

PPO Medicare Plans vs. MSA

A Medicare Savings Account (MSA) is a unique type of Medicare Advantage Plan. These plans combine a high-deductible health plan with a savings account that members use to pay for medical expenses. The savings account is funded by Medicare and can be used for non-Medicare-covered health expenses.

MSA Plans provide more flexibility than PPO Medicare Plans because they do not have networks. Members can see any Medicare-accepting provider nationwide. However, the potential out-of-pocket costs are much higher: MSA Plans can set deductibles as high as $15,750 in 2023.

Benefits and Drawbacks of PPO Medicare Plans

Medicare PPO Plans have many advantages compared to both Original Medicare and other types of Medicare Advantage Plans. However, potential drawbacks must also be considered before enrolling in a PPO.

- Comprehensive coverage

- Lower out-of-pocket costs

- Large provider networks

- Freedom of choice

- Built-in drug coverage

- Extra benefits

- Simplified healthcare

- Network restrictions

- Out-of-pocket costs

- Plan changes

- Prior authorization rules

- Geographic restrictions

- Inconsistent coverage

- Out-of-network care costs

Benefits

- Comprehensive coverage: These plans cover the same benefits as Original Medicare (Part A and Part B), often including extras such as drug coverage or dental care.

- Lower out-of-pocket costs: Unlike Original Medicare, Medicare Advantage Plans set an annual limit on beneficiaries’ out-of-pocket spending.

- Large provider networks: Plan members enjoy access to a broad network of doctors, healthcare providers, and hospitals that contract with the plan.

- Freedom of choice: Plan members can get care outside the network and choose their own specialists without needing a referral.

- Built-in drug coverage: Many plans conveniently bundle Part D into their benefits package.

- Extra benefits: PPOs often provide benefits that are not part of Original Medicare. Benefits vary, but common extras include dental, vision, and hearing aids.

- Simplified healthcare: PPOs bundle beneficiaries’ Part A, Part B, and usually Part D services into one convenient plan.

Drawbacks

- Network restrictions: Plan members typically pay less when they see in-network providers, which is a downside for consumers whose preferred doctors are out of network.

- Out-of-pocket costs: Deductibles, copayments, and coinsurance for in-network and out-of-network services can add up, especially for people who need frequent care. Individuals in this situation should consider HMO plans as an alternative.

- Plan changes: Plans adjust their provider networks, service areas, covered services, covered drugs, and costs from year to year. Some beneficiaries need to switch plans due to these changes.

- Prior authorization rules: Beneficiaries may need approval from their plan before getting certain services or treatments, which delays care.

- Geographic restrictions: Like other Medicare Advantage Plans, Medicare PPOs have service areas. This is a downside for people who travel frequently.

- Inconsistent coverage: Since Medicare PPOs are sold by private insurance companies, covered services, costs, and rules for getting care can vary widely.

- Out-of-network care costs: Medicare PPOs set higher copays or coinsurance for out-of-network providers.

Your Care Network With Medicare Advantage PPO Plans

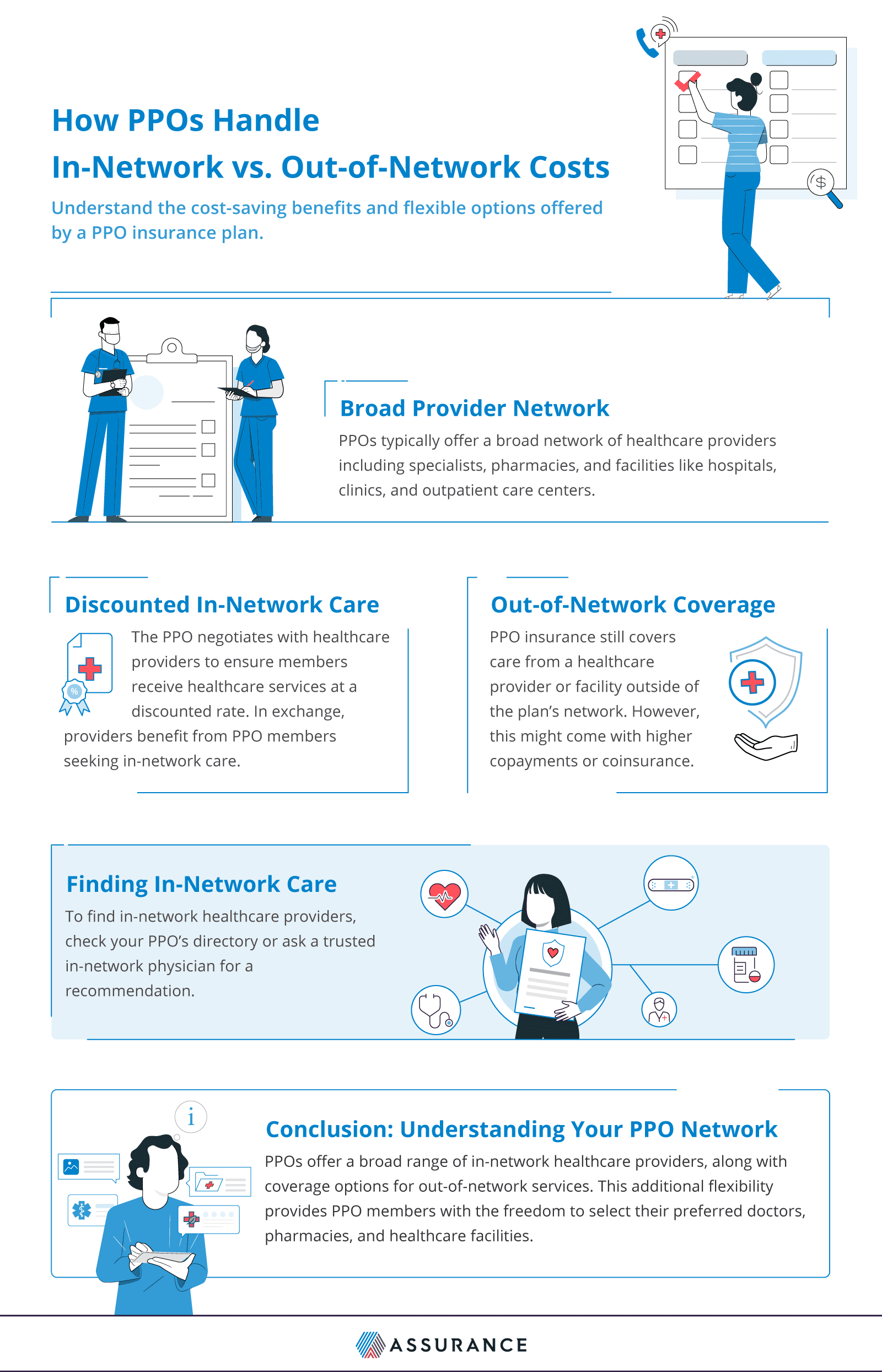

PPO Medicare Advantage Plans provide a network of providers and facilities who’ve agreed to participate in the plan. Beneficiaries can get care outside this network if necessary, but staying in the plan’s network typically makes more sense.

Why Is It Better to Use In-network Care?

Beneficiaries typically enjoy lower out-of-pocket healthcare costs when they stay in their PPO’s network, both at the time of service and over the course of the year. These lower costs make accessing necessary medical care more affordable.

In a Preferred Provider Organization, in-network healthcare providers have agreed to accept certain service fees. These negotiated discounts allow beneficiaries to pay lower prices when they get care. Since out-of-network providers do not have a contract with the plan, their services are not discounted.

Beneficiaries who stay in-network are better protected from high care costs. Medicare Advantage PPO Plans set annual limits on members’ out-of-pocket health spending, and for 2023, spending on in-network services is capped at $8,300. However, the combined cap for in and out-of-network costs is much higher at $12,450.

How Do Medicare PPO Plans Cover Out-of-Network Care?

Medicare PPO Plans allow members to get care from non-network providers; however, these services are covered at a lower level than in-network services. This means plan members pay a higher share of the cost of

Medicare-covered services.

For example, Plan members typically pay $0 to $10 when they see an in-network doctor, but appointments with an out-of-network doctor can cost between $40 and $70. This partial coverage is valuable for consumers who need the flexibility to see out-of-network doctors.

How to Find In-Network Care

Each Medicare Advantage PPO Plan has a provider directory that lists the doctors, healthcare providers, hospitals, and facilities that accept the plan. Visit the plan website to search for in-network providers in your area, or contact the insurer to request a printed directory.

The provider directory is not the only way to find in-network care. If you want to see a specific doctor, consider calling the provider’s office or your insurance company to find out if they belong to the plan’s network.

For individuals who travel frequently, I strongly recommend considering a Preferred Provider Organization (PPO) plan. PPO plans typically offer a broader network of healthcare providers, making it easier for individuals with health needs to find doctors while on the road.

When selecting a PPO plan, it’s important to consider the size of the network, the plan’s coverage, and associated costs. It’s also crucial to review any limitations or restrictions associated with out-of-network care, particularly if you frequently travel outside of your plan’s service area.

The Costs of a Medicare Advantage PPO

Medicare Advantage PPOs help cover plan members’ care costs, but they do not cover all expenses. Here’s a look at the out-of-pocket costs members can expect to pay.

- Premiums: Monthly payments to an insurance company in exchange for coverage. Many plans have $0 premiums, though members still pay their Part A and/or Part B premiums in these plans.

- Deductibles: The amount plan members must pay out of pocket before their Medicare PPO begins paying. Deductibles typically range from around $200 to $1,300, but some plans have a $0 deductible.

- Copayments: An amount members are required to pay when they receive covered services. Copays are typically flat fees, such as $10 or $20.

- Coinsurance: The share of the cost of care members pay after reaching their plan’s deductible. Coinsurance is usually a percentage, such as 20% or 40%. Therefore, if you have 80/20 coinsurance, your insurer pays 80% of the costs after the deductible is met, and you pay the remaining 20%./

- Out-of-network fees: Costs members pay when they get care outside the plan’s network. Typically, these fees are higher copayments or coinsurance.

- Out-of-pocket maximums: An annual limit on members’ spending on covered services. When members reach this limit, their plan pays the full cost of covered services for the rest of the year.

How to Select a Medicare Advantage PPO Plan

In 2023, people with Medicare chose from an average of 43 Medicare Advantage Plans, including PPOs. To narrow down your options and choose the right PPO Plan for your needs, consider the features offered by each plan, such as:

- Covered services: Many plans offer coverage for prescription drugs, dental care, vision care, or other supplemental benefits, but some do not. If you need coverage for a specific benefit, find out if the plan covers it.

- Costs: Compare premiums, deductibles, coinsurance, copayments, and out-of-pocket maximums to estimate your costs. Be sure to note the fees for getting out-of-network care.

- Provider network: Check if the plan covers your preferred doctors, and note the network size. Larger networks give plan members a wider choice of providers.

Get the Most Out of Your PPO Medicare Plan

To make the most of your Medicare Advantage benefits, read your plan documents to understand how your plan works, and keep an eye out for changes that affect your coverage, such as:

- Network changes: Providers are allowed to leave the network at any time. Plans typically provide 30 days’ notice if a doctor you see regularly is leaving the network, but it’s a good idea to confirm providers are still in-network when you book an appointment.

- Plan changes: Each year, Medicare Advantage Plans make changes to their covered services and costs. Plan members receive an Annual Notice of Change each fall that details these changes, so read it carefully to find out if the plan still works for your needs.

- Prior authorization rules: Before receiving certain covered services, plan members may need approval from their plan. Without this prior approval, the service is not covered. Read the plan’s Evidence of Coverage to learn which services require prior authorization.

Putting It All Together

PPO Medicare Advantage Plans are a popular alternative to Original Medicare that offer many benefits for plan members, including lower out-of-pocket costs and large provider networks. However, they also have some drawbacks to keep in mind, such as out-of-network fees, prior authorization requirements, and higher monthly premiums.

For some people, enrolling in a Medicare PPO makes sense. Others might prefer to stay in Original Medicare or join a different Medicare Advantage Plan type, such as an HMO or MSA. Carefully weigh the pros and cons of each option to choose a Medicare health plan that’s right for you.