Because short-term health insurance offers an alternative to a traditional healthcare plan, many people find short-term health insurance worth it for temporary gap coverage, such as when between jobs or open enrollment periods. Short-term health insurance may also be a good idea for those nearing Medicare eligibility within a few months.

These plans offer limited coverage for a brief period, the length of which varies by state. Applicants can enroll at any time. Short-term health insurance plans tend to have lower premiums than traditional healthcare plans available through the Health Insurance Marketplace, though it should be noted that those who are eligible for subsidies may still find traditional health insurance plans more affordable.

Table of Contents

- What Is Short-term Health Insurance?

- When Short-term Health Insurance Could Be a Good Idea

- When Short-term Health Insurance Is a Bad Idea

- How Much Do Short-term Health Insurance Plans Cost?

- States That Ban Short-term Health Insurance

- Check to See if You Are Eligible for a Special Enrollment Period

- How to Buy Short-term Health Insurance

What Is Short-term Health Insurance?

Short-term Health Insurance | Traditional Marketplace Health Insurance | |

|---|---|---|

Meets ACA regulations for benefits | Not required | Yes |

Covers pre-existing conditions | Not required | Yes |

Enrollment windows | None; enrollment is open year-round | Open Enrollment Period or Special Enrollment Period |

Average cost | Lower premium than traditional marketplace plan, but higher deductible and less coverage | Higher premium than short-term health plan, but lower deductibles and more coverage |

Coverage length | Up to 364 days | Full-year |

Renewal limits | Can renew for up to 36 months | Can renew indefinitely |

Availability | Not available in some states | Available in every state |

Short-term health insurance plans differ from traditional health insurance plans in several areas. Whereas traditional health plans from the Health Insurance Marketplace must comply with Affordable Care Act (ACA) guidelines, short-term health insurance providers are self-regulated and vary by state. Unlike ACA plans, short-term plans are not required to accept applicants with pre-existing conditions nor cover the 10 essential health benefits.

Short-term health insurance beneficiaries receive limited coverage compared to ACA plans. For example, short-term insurers can and often do deny coverage to candidates with pre-existing conditions. These providers typically require applicants to submit to an underwriting process to determine their eligibility. Common pre-existing conditions include cancer, clinical depression, and diabetes.

If accepted, candidates may still pay out-of-pocket costs for many benefits. Most short-term health insurance policies exclude coverage for the 10 essential health benefits including preventive care, maternity care, and prescription drugs.

Short-term health insurance providers issue identification cards that detail temporary benefits, and plans are typically not renewable after the term of coverage ends, which is less than 12 months. However, some providers allow beneficiaries to reapply for short-term coverage as many times as needed.

When Short-term Health Insurance Could Be a Good Idea

While it may not offer the comprehensive benefits of a traditional policy, short-term health insurance may be a good idea in select circumstances, especially for candidates who would otherwise go uninsured. Limited coverage—including for medical emergencies and basic outpatient medical care—is better than no coverage for those who cannot afford higher premiums.

Temporary coverage also benefits those who are uninsured and stuck between enrollment periods. Many short-term health insurance providers offer immediate activation of benefits for accepted applicants once they begin premium payments. These plans are ideal for workers who have been laid off, are waiting on employer-funded coverage to begin, or cannot afford COBRA (Consolidated Omnibus Budget Reconciliation Act).

Short-term health insurance can also benefit adults who are no longer eligible dependents on their parent’s plan, recent college graduates seeking employment, or those months from Medicare eligibility.

There are several instances where short-term health insurance may be a good idea for you, including:

You Lost Health Coverage Outside of Open Enrollment and Do Not Qualify for a Special Enrollment Period

People may qualify for a special enrollment period — a period outside of open enrollment in which you can purchase ACA-compliant health insurance — only in specific circumstances.

Qualifying events include but are not limited to losing employer-funded health coverage due to job loss, getting married, or having a baby.

People who do not qualify for a special enrollment period and missed the open enrollment deadline may seek short-term health insurance to get temporary coverage. While a short-term health insurance policy does not cover the 10 essential health benefits or guarantee coverage for pre-existing conditions, it is better than going uninsured in between open enrollment periods.

You Are Uninsured and Waiting for Upcoming Health Insurance Coverage to Kick In

Short-term health insurance is ideal for people waiting for their upcoming health insurance plan to go into effect. Examples of this scenario include starting a new job that will offer employer-sponsored health insurance within the coming year or joining your spouse’s employee-funded insurance policy after you get married.

Since most traditional healthcare policies include a waiting period before coverage is activated, a short-term health insurance policy can provide interim coverage to avoid a lapse in benefits. Short-term plans tend to be more affordable than COBRA benefits, which also provide temporary coverage after employer benefits end.

You Are Uninsured and Waiting for Medicare to Kick In

Some people experience a gap between losing their employer-sponsored health insurance and Medicare eligibility, as is the case if you lose your job or retire shortly before you turn 65. People become Medicare-eligible when they reach 65 years of age, or are under 65 but have a qualifying disability or end-stage renal disease.

Medicare enables applicants to enroll starting three months before they turn 65 up until three months after the month they turn 65. Seniors who know they will start receiving benefits on this important birthday may experience a lapse in coverage after employer-sponsored benefits end. Short-term health insurance can provide gap coverage before Medicare enrollment begins.

Short-term health insurance may not provide permanent, comprehensive coverage or treatment for chronic conditions. However, like in other scenarios such as missing the open enrollment window or losing your job, temporary coverage before Medicare kicks in is better than no coverage at all.

When Short-term Health Insurance Is a Bad Idea

While short-term health insurance is worth it as a last resort, enrolling in a traditional ACA-compliant health insurance plan is a better choice whenever possible. The lack of standardized regulations among short-term health insurance plans means more eligibility restrictions, coverage limitations, and geographical limitations than an ACA plan.

There are several instances where short-term health insurance could be a bad idea for you, including:

You Need an Essential Health Benefit

Short-term health insurance is not required to cover essential health benefits, which is especially detrimental for candidates seeking coverage including prenatal, dental, vision, or mental health care services. The regulations created to ensure that all ACA plans provide these benefits do not apply to short-term policies, which are governed by state rules and regulations.

You Have a Pre-existing Condition That Requires Coverage

Temporary health insurance providers also commonly deny coverage for pre-existing conditions. Many people understandably seek temporary coverage to avoid a lapse in treating their pre-existing condition, but you should check if the short-term health insurance plan you’re considering offers coverage.

You Want to Avoid the Medical Underwriting Process

With a traditional health insurance plan, insurers cannot use your health status or pre-existing conditions to raise your premiums. However, as short-term health insurers are not bound to ACA regulations, many require applicants to undergo a rigorous underwriting process to be eligible for benefits and pay higher rates if accepted.

How Much Do Short-term Health Insurance Plans Cost?

The monthly premiums for short-term health insurance policies are usually more affordable than those of a traditional ACA plan. For example, ACA plans may cost $100 or more each month for coverage than a short-term health insurance plan for the same individual. However, when looking at the total costs associated with health coverage, short-term health insurance tends to be less cost effective.

Like traditional health insurance policies, short-term health insurance plans involve premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. Providers commonly sell plans with out-of-pocket maximums of up to $10,000, deductibles of around $3,500, and a 20% coinsurance rate.

Premiums

Premiums for short-term health insurance are usually lower than ACA plans. However, most short-term health insurance policies require beneficiaries to pay the entire premium (price of the policy) up front, instead of in monthly installments. This can make purchasing a short-term policy a greater financial hit.

Deductible

Short-term health insurance providers also set a deductible, or the amount you pay for healthcare services before insurance begins covering expenses. The lower premiums of short-term health coverage often require higher deductibles.

Copays and Coinsurance

Many short-term plans require copays, or set fees, for routine services. These do not count toward out-of-pocket limits or deductibles.

Coinsurance is the percentage of the covered expenses the insurer will pay toward the total after the deductible is met. Beneficiaries with chronic issues or recurring health needs may incur higher coinsurance and out-of-pocket costs.

Out-of-pocket Maximum

While many short-term plans feature out-of-pocket maximums, beneficiaries may not reach these limits as expected since temporary insurance may not cover all needs. In other words, with ACA insurance, more healthcare services are covered, and all of those count towards your annual out-of-pocket maximum, or the most you would spend each year before your insurance covers 100% of the remaining costs.

With short-term health insurance, this out-of-pocket maximum may be more difficult to reach because it offers far less coverage of healthcare services that would count towards your out-of-pocket maximum.

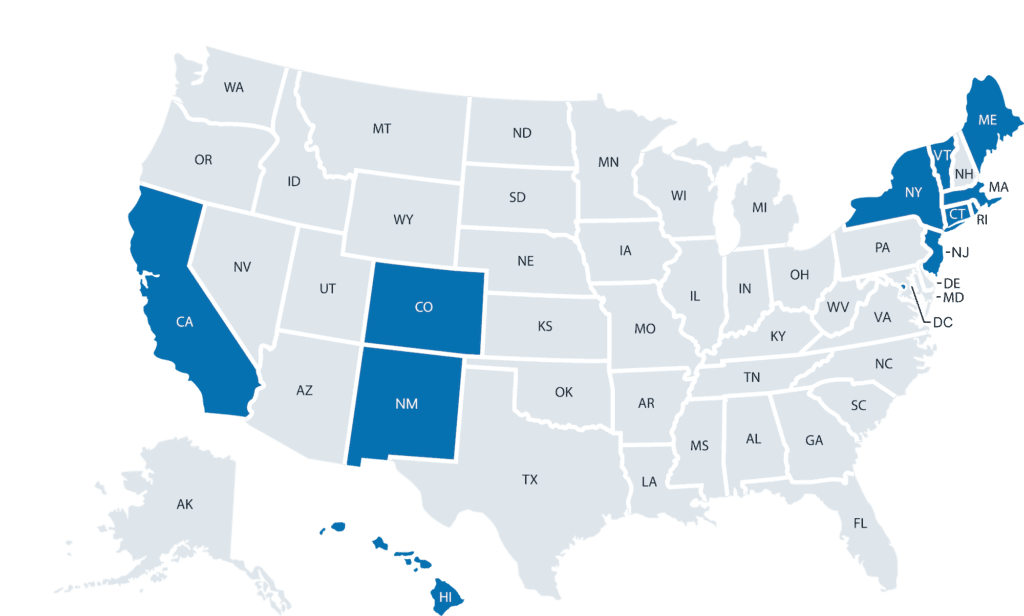

States That Ban Short-term Health Insurance

Short-term health insurance is not an option for everyone in every state. Since the Trump administration introduced new laws in 2018 enabling states to enact stricter regulations around short-term insurance, many states offer limited or no short-term policy options for residents.

The following states and territories have regulations or bans on the sale of short-term health insurance:

State | Regulation or Ban |

|---|---|

California | Short-term health policies banned from sale |

Colorado | Short-term health policy options limited due to regulations |

Connecticut | Short-term health policy options limited due to regulations |

Hawaii | Short-term health policy options limited due to regulations |

Maine | Short-term health policy options limited due to regulations |

Massachusetts | Short-term health policies banned from sale |

New Jersey | Short-term health policies banned from sale |

New Mexico | Short-term health policy options limited due to regulations |

New York | Short-term health policies banned from sale |

Rhode Island | Short-term health policy options limited due to regulations |

Vermont | Short-term health policy options limited due to regulations |

Washington DC | Short-term health policy options limited due to regulations |

Some states have banned or imposed enough regulations on short-term health insurance offerings that temporary policies are now unavailable. As of 2022, California, Massachusetts, New Jersey, and New York have banned the sale of short-term health insurance policies.

While not entirely banned, short-term health insurance is limited in states like Colorado and Maine due to tighter restrictions in recent years. Other states including Connecticut, Hawaii, and New Mexico imposed regulations requiring short-term plans to cover essential health benefits and/or pre-existing conditions. As a result, insurers chose not to sell policies there.

Check to See if You Are Eligible for a Special Enrollment Period

Before purchasing short-term health insurance, make sure you are not eligible for a special enrollment period. Special enrollment periods enable some individuals to purchase health insurance outside of the annual window set by the Health Insurance Marketplace. Common triggers that qualify candidates for a special enrollment period include life, household, or residence changes in the last 60 days.

Specifically, individuals may qualify for a special enrollment period if they lost health coverage due to job loss or denial of Medicare or Medicaid benefits, or aged out of their dependent status on a family plan. The Marketplace may also offer a special enrollment period to individuals who have lost health coverage and have not enrolled since January 1, 2020 due to a COVID emergency.

Other triggers for special enrollment periods include losing health insurance as a result of moving residences within or to the U.S., getting married, having a baby, or becoming divorced or legally separated. Other less common qualifiers include becoming a member of a federally recognized tribe, leaving an incarceration facility, or becoming a U.S. citizen.

Make Sure You Don’t Miss the Open Enrollment Period

Open enrollment is the annual window for enrolling in and renewing ACA plans. The Healthcare Marketplace opens enrollment during this time each year to beneficiaries looking to make changes to their existing ACA plans or buy an ACA policy after short-term health insurance.

Short-term health insurance beneficiaries lose their opportunity to buy an ACA plan for the entire year once the Marketplace closes. Most states offer ACA plans through the national HealthCare.gov marketplace, open November 1 through January 15 of the following year in most states. Others run their own state-funded marketplaces with varying open enrollment dates.

How to Buy Short-term Health Insurance

If short-term health insurance is available in your state and will prevent a lapse in coverage, it can be a good stopgap until the next Open Enrollment Period. Remember that even if your state does not ban the sale of short-term health insurance, options may be highly restricted and therefore limited. Many people seek out experienced insurance agents for help.

Next, browse only legitimate plans from trustworthy companies. Many national brands known for issuing traditional insurance policies also offer short-term coverage. Customers can compare multiple insurance carriers (if available in their state) based on personalized quotes, consumer reviews, and agent referrals. Make sure to clarify which services are covered and the policy term.